The following memorandum summarizes the say on pay voting results in Canada (among the TSX Composite companies) and the U.S. (among the S&P 500 companies) based on results released by April 30, 2025.

Canada Results

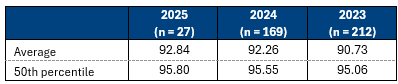

At this point in the AGM cycle, 27 Canadian companies have reported their say on pay results for 2025. Early indication suggests slightly increasing results year-over-year as summarized in Table 1.

Table 1 – Canada say on pay results

Earlier this year, the Globe and Mail’s ‘Board Games’, a commonly cited source of corporate governance in Canada, released its evaluation criteria for 2025. Issuers garnering at least 90% shareholder support for say on pay in the prior year will receive full marks. On the other hand, those receiving less than 80% votes in the prior year and not disclosing changes to their compensation plans and engagement details with shareholders will get zero marks. Despite that the say on pay vote is non-binding, shareholders expect concrete responses and transparent board engagement should companies receive low support for their executive compensation plans.

Companies trigger proxy advisors ISS and Glass Lewis’ board responsiveness evaluation when their say on pay support levels fall below 80%. Issuers’ responses generally should include engagement efforts, shareholder feedback, actions taken, and rationale for pay decisions.

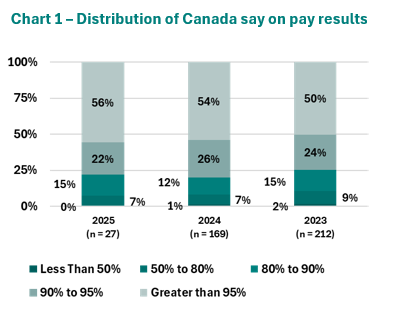

As illustrated in Chart 1, the distribution of early say on pay results indicate consistent year-over-year support with 56% of companies receiving over 95% support, 22% receiving 90% to 95% support, 15% receiving 80% to 90% support and 7% receiving 50%-80% support (or two companies) and no company failing.

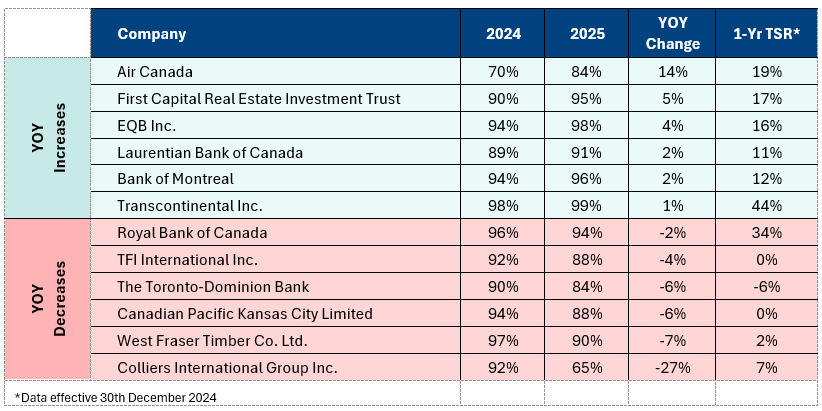

Of the 27 reporting companies, close to 89% of companies reported results that changed less than 10 percentage points on a year-over-year basis. Table 2 summarizes the companies with the biggest year-over-year increases and decreases in their voting levels.

Table 2 – Biggest year-over-year changes in say on pay voting results

US Results

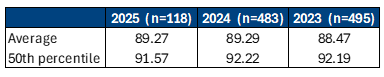

In the US, among the 118 S&P 500 companies that reported as of the end of April 2025, the average level of support is similar to last year’s results (refer to Table 3).

Table 3 – US say on pay results

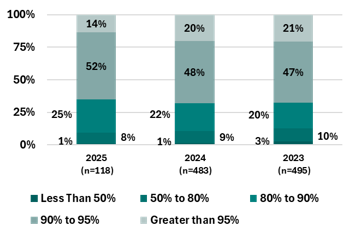

While the percentage of companies garnering more than 95% shareholder support fell to 14%, the overall proportion of companies receiving over 80% support slightly increased from 90% to 91%. On the other hand, the share of companies with less than 50% support remained steadily at 1%, as illustrated in Chart 2.

Chart 2 – Distribution of US say on pay results

Key Insights

- Concerns around egregious one-time awards: Shareholders and proxy advisors are generally skeptical towards egregious special grants to CEOs and/or other NEOs. These one-time awards usually are issued outside the routine executive pay programs and are typically significant in their quantum. Shareholder concerns arise regarding the robustness of companies’ regular pay structure, should an outside grant be deemed necessary. Absent a compelling rationale, rigorous performance measures, and an extended vesting period, these egregious special grants are generally considered problematic pay practices. ISS in its Canadian benchmark voting guideline states that certain adverse pay practices may warrant negative votes on a stand-alone basis in particularly egregious cases. In its 2025 Canadian proxy voting guideline, Glass Lewis also clarified that no one factor would ordinarily lead to a negative say on pay recommendation, except for particularly egregious pay decisions and practices.

- Skepticism toward adjustments to performance results:As an alternative to one-time special grants that are generally viewed negatively and attract close scrutiny from investors, companies tend to choose to undertake adjustments to performance results, usually under short-term incentive plans, to award the executives for special achievements, such as successful acquisitions and integrations. Nevertheless, shareholders have exhibited increasing awareness in recent years when companies make mid-year or post-year adjustments to their pay programs. Notably, Glass Lewis recently added “adjustments to performance results that lead to problematic pay outcomes” to its list of problematic pay practices in its 2025 Canadian proxy voting guideline.

About The Author

Anqi Xu, Consultant

Anqi is a Consultant at Southlea Group and leads the Compensation Governance team.

Prior to joining Southlea Group, she worked as Associate Vice President at a global proxy advisory firm, producing independent and objective shareholder meeting research reports with voting recommendations for institutional investors. She is also the Canadian research team’s E&S lead with in-depth expertise in the E&S shareholder proposal focus area,

Anqi also worked as Vice President at a Canadian strategic advisory firm, advising boards and committees on complex corporate governance matters. She provided strategic advice to public issuers on executive compensation and played an instrumental role in multiple successful Say on Pay turnarounds.

Anqi has experience supporting and evaluating executive compensation structures and disclosures of public-traded companies, the S&P/TSX Composite Index issuers in particular, across various sectors. Anqi has a Bachelor of Arts in Economics and Art History from the University of California, Los Angeles (UCLA) and a Master of Financial Accountability degree from York University. She also holds a Chartered Financial Analyst (CFA) designation.