The primary role of the Board is to attract, retain, and engage an effective leadership team. Discussions about pay and performance, and talent should now be integrated throughout the year rather than being limited to specific quarters. Continuous talent and pay discussions are essential for maintaining a stable, sustainable, and high-performing leadership team.

Human Resources Committees (HRC) have expanded their mandates from holding three annual meetings on pay levels and incentive payouts to conducting four to six meetings that include broader discussions on talent, succession planning, diversity, equity, and inclusion (DE&I), culture, and employee engagement.

As advisors to HRCs across Canada, Southlea provides insights, tools, and templates to support more effective processes and facilitate comprehensive discussions about executive talent. Additionally, Southlea offers tools to ensure that compensation programs are designed to effectively retain, engage, and support the executive talent agenda within your organization.

Key Takeaways

- Start CEO succession planning early and keep it ongoing.

- Integrate talent, succession, and pay discussions considering each executive’s unique situation.

- Proactively review “walk away” and “hold back” values to address vulnerabilities in the executive team.

- Use pay strategically to differentiate likely successors based on market positioning and be aware of their external pay opportunities.

CEO Succession and Transition Planning

It is generally known that the CEO’s tenue is not forever with the average tenure of seven years. We have seen when CEO succession has gone wrong – negative media attention, increased shareholder scrutiny, lawsuits, proxy fights, and high exit packages. Here are best practices to ensure a smooth process:

- Align on CEO profile that reflects the organization’s desired future state

- Start early – you always think you have more time than you do, however the development of talent takes time, so that succession planning is an ongoing conversation and not an annual “tick the box” exercise

- Consider talent market – both internal and external, the next successor may not always be a current internal candidate

- Hold the CEO accountable – the Board cannot do it without the CEO’s support so build into compensation & assessment process

- Use of an external advisor to assess the talent, skills, and qualifications vs. CEO’s assessment

- Development opportunities vary – from education to job rotations to special projects

Compensation and Human Capital Management

Discussions about talent management and pay are often conducted separately. However, integrating these discussions is essential to ensure effective succession planning. The board should be informed of each executive’s circumstances and understand how to keep them engaged, motivated, and appropriately compensated over time.

Some things to think about:

- Individual risk factors – Consider the age and career stage of executives, their retirement eligibility, and the retention hold/buyout value.

- Define retirement across all compensation programs – For instance, long-term incentive (LTI) plans typically allow continued full vesting of outstanding LTI grants upon retirement. Once an executive is retirement eligible, they have the option to retire, potentially creating a retention challenge for the company.

- Differentiate between the treatment of outstanding incentives for not for cause termination and retirement. If these treatments are the same, it might encourage executives to wait for an exit package rather than choose retirement.

- Evaluate beyond pay – Assess where executives are in their personal journey, their ambitions, and how the company can offer development opportunities and experiences that provide retention incentives beyond compensation.

Checking for Talent and Pay Vulnerabilities in Executives and Successors

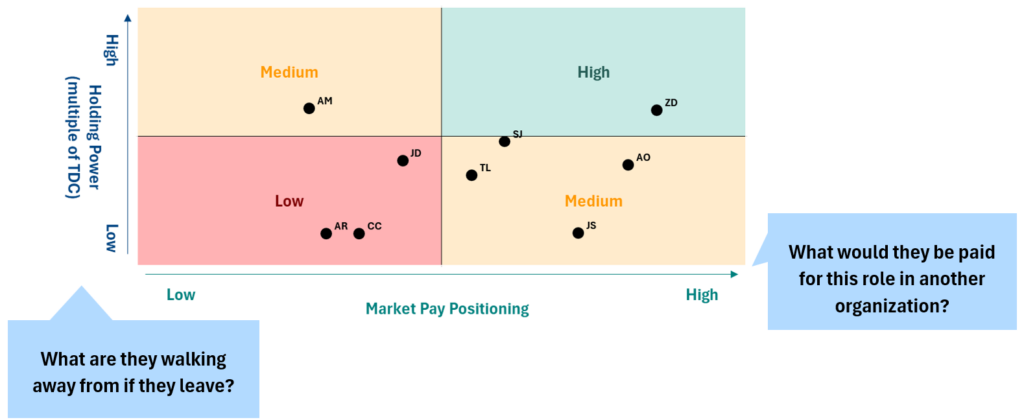

Organizations typically conduct thorough processes to understand their talent and assess retention for each individual but often fail to integrate these evaluations. A systematic method for accurately determining the retention risk of key leadership talent involves assessing everyone’s market pay positioning and retention hold within a matrix framework.

This can also assist in the differentiation of each individual relative to the team – which positions are right ones to be positioned higher compared to market and who has or does not have enough outstanding equity. The top right quadrant (high market positioning and high retention hold / buyout value) should be the most important executives in the organization, e.g., the CEO successor.

About The Author

Christina Le, Senior Consultant

Christina has over 10 years of experience providing a broad perspective on how companies design effective executive compensation programs to meet their specific needs. She is well-versed in financial and cost modeling, scenario analysis and project management.

She provides comprehensive support to human resources committees and senior management in a variety of executive and broad-based employee compensation matters, including:

- Annual, energy marketing and trading and long-term incentive (equity) plan design and/or redesign including valuation, performance measurement, target setting and calibration;

- Pay-for-performance analytics to ensure alignment between executive and shareholder interests;

- Tailoring solutions for clients preparing for or responding to the impact of significant mergers or acquisitions on their compensation programs (pre-announcement through to post merger); and

- Supporting organizations improve proxy circular disclosure to effectively describe compensation decisions to shareholders and proxy advisors

Christina consults to a broad range of clients including publicly traded companies, privately held firms within the natural resources industry including oil & gas, chemicals, energy and mining.

Christina holds a Bachelors of Commerce with Honours degree from the Sauder School of Business at the University of British Columbia and the Chartered Financial Analyst (CFA) designation.