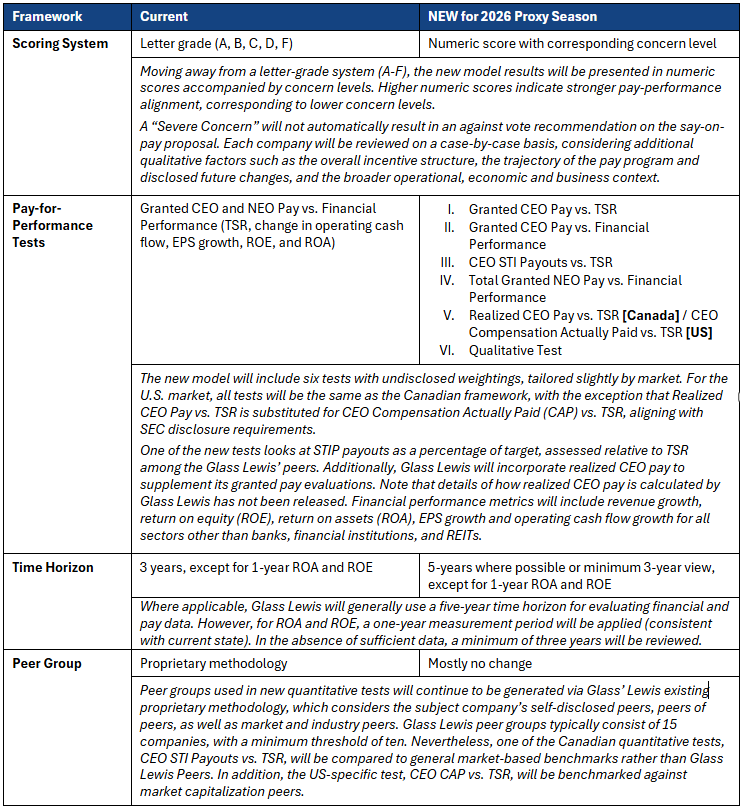

Effective in 2026, Glass Lewis will implement a new pay-for-performance model for U.S. and Canadian markets, replacing its current framework. The enhanced model aims to provide a more comprehensive review of executive pay and performance alignment. Key changes to the model are highlighted below:

Unlike ISS, which relies on reported grant date fair values for equity awards, Glass Lewis conducts its own valuation for equity-based awards. As a result, the granted CEO pay used in the Glass Lewis model often diverges from reported CEO pay in issuers’ proxy disclosure. In the new model, Glass Lewis is broadening its evaluation scope to incorporate CEO STI payout and realized pay. Another notable distinction is the construction of their proprietary peer groups. For Canadian-incorporated issuers, ISS limits its peer group to Canadian companies. In contrast, Glass Lewis peer groups typically include a broader set of North American peers, which enables the comparison of subject companies with US peers where relevant. This broader cross-border comparison may influence the underlying pay and performance alignment evaluation.

While Glass Lewis’ new model has experienced several significant changes, we expect that the model result and vote recommendations will not materially change. Southlea will continue to monitor and share updates released by Glass Lewis and the implications for companies as we approach the 2026 proxy season.

About The Author

Anqi Xu, Consultant

Anqi is a Consultant at Southlea Group and leads the Compensation Governance team.

Prior to joining Southlea Group, she worked as Associate Vice President at a global proxy advisory firm, producing independent and objective shareholder meeting research reports with voting recommendations for institutional investors. She is also the Canadian research team’s E&S lead with in-depth expertise in the E&S shareholder proposal focus area,

Anqi also worked as Vice President at a Canadian strategic advisory firm, advising boards and committees on complex corporate governance matters. She provided strategic advice to public issuers on executive compensation and played an instrumental role in multiple successful Say on Pay turnarounds,

Anqi has experience supporting and evaluating executive compensation structures and disclosures of public-traded companies, the S&P/TSX Composite Index issuers in particular, across various sectors.

Anqi has a Bachelor of Arts in Economics and Art History from the University of California, Los Angeles (UCLA) and a Master of Financial Accountability degree from York University. She also holds a Chartered Financial Analyst (CFA) designation.