The following memorandum summarizes the say on pay voting results in Canada (among the TSX Composite companies) and the U.S. (among the S&P 500 companies) based on results released by July 15, 2025. The data were collected by ESGAUGE, a data analytics firm.

Key Takeaways

- Say on pay vote results in Canada and the US remain strong, with average support levels consistent with last year.

- The shareholder voting landscape is becoming more divergent and it is important to understand the objectives of your specific investor base rather than following the standard voting policies of the proxy advisors.

- While the proxy advisor influence on say on pay results in both the Canadian and US markets is still undeniable, clear disclosure and board-shareholder engagement remain key channels to convey issuers’ executive pay philosophy. Complex pay decisions in a challenging business environment necessitate a robust shareholder engagement process to reinforce say on pay support.

- For Canadian issuers, the change to ISS’ U.S. policy on PSU disclosure is not immediately applicable but indicates the potential future direction of ISS and suggests that there is room for improvement in the transparent disclosure of PSU design, going beyond Canadian disclosure rules.

Canada Results

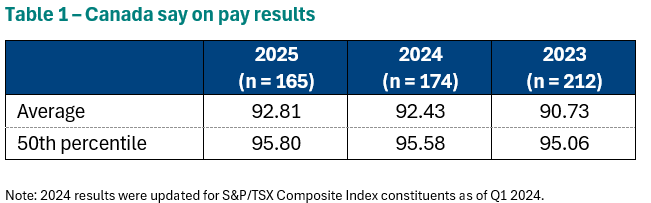

At this point in the AGM cycle, 165 Canadian companies have reported their say on pay results for 2025. Similar to the May update, voting results have slightly increased year-over-year as summarized in Table 1.

Earlier this year, the Globe and Mail’s ‘Board Games’, a commonly cited source of corporate governance in Canada, released its evaluation criteria for 2025. Issuers garnering at least 90% shareholder support for say on pay in the prior year will receive full marks. On the other hand, those receiving less than 80% votes in the prior year and not disclosing changes to their compensation plans and engagement details with shareholders will get zero marks. Although the say on pay vote is non-binding, shareholders expect concrete responses and transparent board engagement should companies receive low support for their executive compensation plans.

Companies trigger proxy advisors ISS and Glass Lewis’ board responsiveness evaluation when their say on pay support levels fall below 80%. Issuers’ responses generally should include engagement efforts, shareholder feedback, actions taken, and rationale for pay decisions.

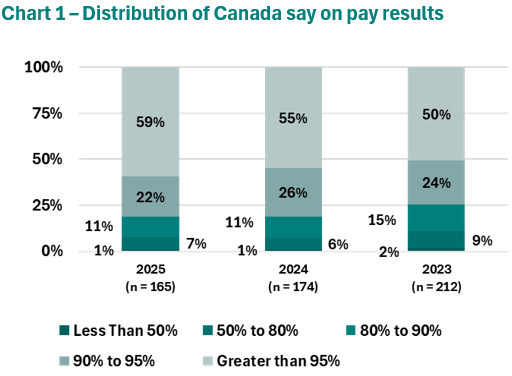

As illustrated in Chart 1, the distribution of say on pay results indicate increasing year-over-year support with approximately 60% of companies receiving over 95% support, 22% receiving 90% to 95% support, 11% receiving 80% to 90% support and 7% receiving 50%-80% support and two companies (First Majestic Silver Corp. and Aya Gold & Silver Inc.) failing.

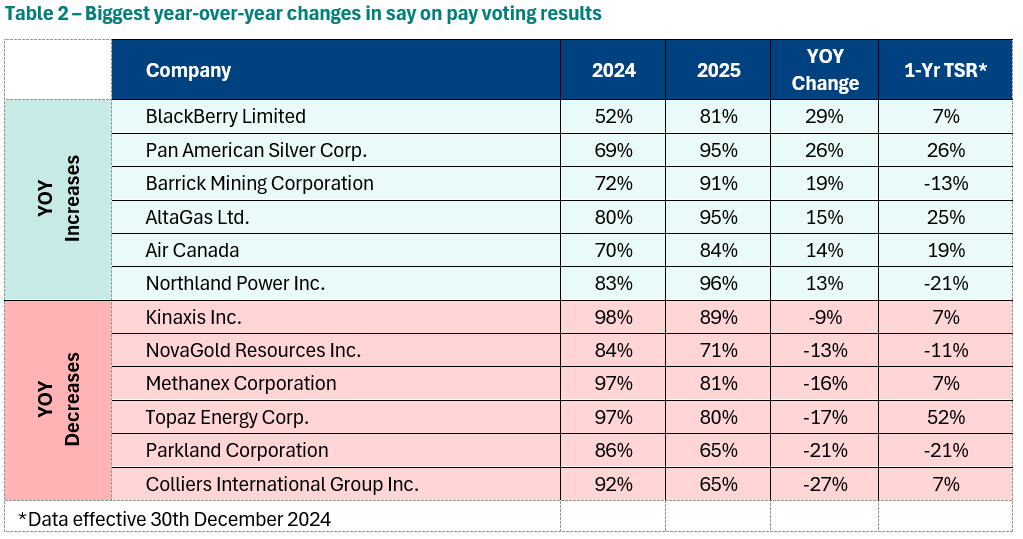

Of the 165 reporting companies, close to 85% of companies reported results that changed less than 10 percentage points on a year-over-year basis. Table 2 summarizes the companies with the biggest year-over-year increases and decreases.

US Results

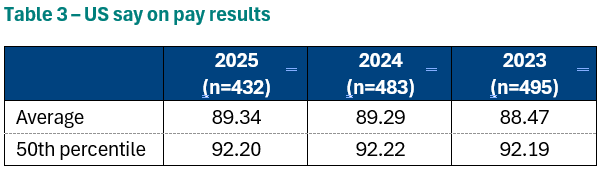

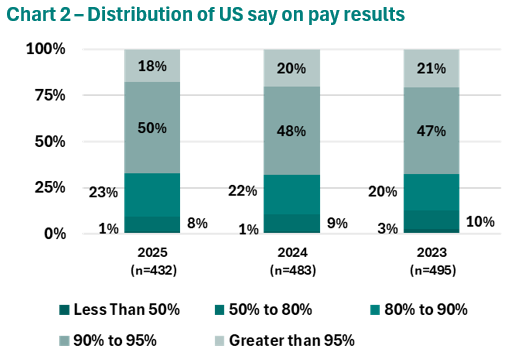

In the US, among the 432 S&P 500 companies that reported as of July 15, 2025, the average level of say on pay support is similar to last year’s results (refer to Table 3).

The overall proportion of companies receiving over 80% support remained around 90% but the percentage of companies garnering more than 95% shareholder support fell to 18%. On the other hand, the share of companies with less than 80% support slightly decreased from 10% to 9%, as illustrated in Chart 2.

The Changing Investor Landscape

- The Role of Proxy Advisors on Say on Pay: Proxy reports conducted by independent proxy advisors have been a reliable tool for their institutional investor subscribers, to the extent that many large passive investors are prone to automatically follow proxy advisors’ voting recommendations in their votes, given their extensive portfolio and limited capacity. Nevertheless, in cases of negative vote recommendations, asset managers, both passive and active, tend to derive their own voting decisions on a case-by-case basis. These decisions are primarily driven by engagement discussions with corporate issuers and institutional investors’ internal voting guidelines and stewardship objectives. In other cases, some investors, particularly active asset managers, may choose only to use proxy reports as a source of contextual information. The influence of proxy advisors remains under scrutiny, and the Trump administration may renew proposed restrictions on them, which would limit their ability to provide independent advice that is not heavily influenced by the issuer.

- Custom Voting Policies: To better align with their stewardship guidelines, institutional investors tend to tailor their voting policies considering region and firm-specific factors. One of the top proxy advisors, ISS, has been offering voting recommendations to targeted clients based on specialty policies, such as Taft-Hartley and Socially Responsible Investment (SRI), in addition to its proprietary benchmark voting policies. ISS also customizes policies and recommendations for some large asset managers to meet its clients’ stewardship objectives. Starting for the 2026 proxy season, Glass Lewis will also develop and implement custom policies for its clients as an alternative to the existing Glass Lewis policy to recognize diversified client needs. It will also open its platform to third-party voting policies, including other proxy advisors and institutional stakeholder groups.

- Pay for Performance Alignment: Starting with the 2025 proxy season, ISS in the U.S. placed greater focus on performance share unit (PSU) disclosure and their design, particularly for companies that exhibit quantitative pay for performance misalignment. ISS views the following PSU attributes and disclosure practices negatively:

- Non-disclosure of forward-looking goalsPoor disclosure of closing-cycle vesting resultsPoor disclosure of the rationale for changes to metrics or program designUnusually large pay opportunities, including max vesting opportunitiesNon-rigorous goals that do not appear to strongly incentivize outperformance

- Overly complex structures

About The Author

Anqi Xu, Consultant

Anqi is a Consultant at Southlea Group and leads the Compensation Governance team.

Prior to joining Southlea Group, she worked as Associate Vice President at a global proxy advisory firm, producing independent and objective shareholder meeting research reports with voting recommendations for institutional investors. She is also the Canadian research team’s E&S lead with in-depth expertise in the E&S shareholder proposal focus area,

Anqi also worked as Vice President at a Canadian strategic advisory firm, advising boards and committees on complex corporate governance matters. She provided strategic advice to public issuers on executive compensation and played an instrumental role in multiple successful Say on Pay turnarounds.

Anqi has experience supporting and evaluating executive compensation structures and disclosures of public-traded companies, the S&P/TSX Composite Index issuers in particular, across various sectors. Anqi has a Bachelor of Arts in Economics and Art History from the University of California, Los Angeles (UCLA) and a Master of Financial Accountability degree from York University. She also holds a Chartered Financial Analyst (CFA) designation.