Minimum share ownership requirements have become a common policy adopted by most publicly traded companies. The granting of long-term incentives and share ownership by executives support long-term sustainable value creation by aligning executives with shareholders, while share ownership also creates a stronger ownership mentality and acts as a risk mitigator.

Most investors and their advisors (e.g., ISS and Glass Lewis) are generally silent on the design of share ownership policies and tend to look at whether executives have meaningful ownership, but this is not necessarily described as a formal policy. The Globe and Mail’s Board Games tends to provide the most specific guidance for CEO share ownership referred by major Canadian companies, including a minimum requirement of 3x base salary that is based on shares and earned share units, and calculated using the current market value.

Because of these perspectives, share ownership guidelines have tended to become an optics exercise for disclosure to governance groups and shareholders. In this report, we review whether ownership guidelines are achieving their intended purpose, or whether the design features of current policies have led to unintended consequences, encouraging notional ownership vs. actual ownership. In partnership with ESGAUGE, an ESG analytics firm, we reviewed disclosed share ownership policies for the CEOs of the S&P/TSX 60 along with current share holdings relative to the disclosed policy.

MARKET PRACTICE

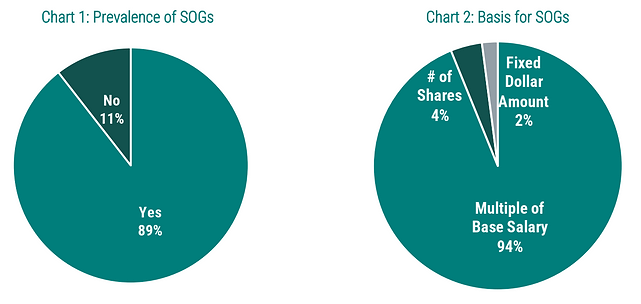

As summarized in Chart 1, most S&P/TSX 60 companies have disclosed share ownership guidelines (SOGs) for their CEO and most SOGs are expressed as a multiple of base salary (refer to Chart 2) rather than as a fixed number of shares or as a fixed dollar amount. The multiple of base salary adjusts for changes in salary over time but is not formally linked to changes in the value of granted long-term incentives (LTIs), which are generally used to build share ownership over time.

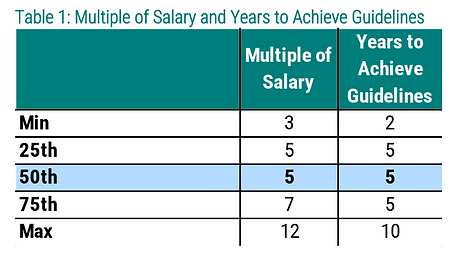

As shown in Table 1, the multiple of salary tends to range from 5 to 7x base salary but can vary from a low of 3x to a high of 12x. Like the relationship between company size and CEO pay, we find higher multiples among larger companies that have higher compensation levels, particularly LTIs. These multiples represent the largest Canadian companies (average market cap. of $35B) and would need to be scaled accordingly for the broader market.

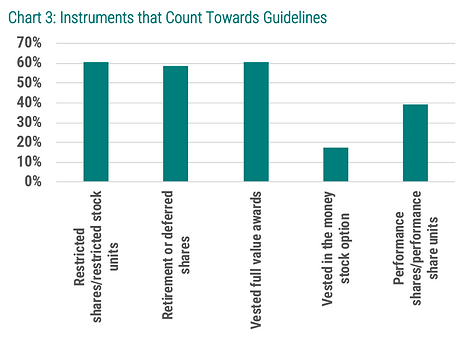

In Chart 3, we summarize the instruments that count towards share ownership guidelines in addition to actual common share holdings (by executive or immediate family members). Approximately 60% of organizations include long-term incentives that are certain in value (such as deferred share units and vested full value shares), while fewer organizations include long-term incentives with less certain value such as vested in the money stock options or performance share units. The inclusion of more instruments makes it easier for an executive to comply relative to a policy that only includes common shares (i.e., a 5x multiple that includes performance share units is easier to achieve).

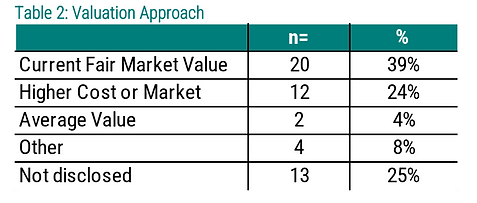

In Table 2, we look at the valuation approach. Approximately 40% disclose the use of the current fair market value as of the measurement date, while 25% of companies disclose the use of the higher of cost or market value, which helps to address share price volatility that can affect compliance when measured using the share price on a single day.

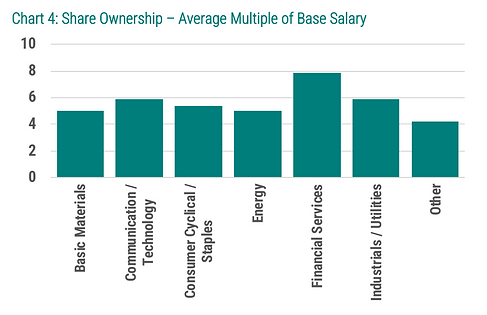

As illustrated in Chart 4, we do not observe material differences in the share ownership multiples with most industries averaging around 5 to 6x salary. The only difference is the financial services sector, where the average multiple is 8x salary; however, we note that financial services companies are more likely to include performance share units in their calculation, making it relatively easier to comply with a higher multiple.

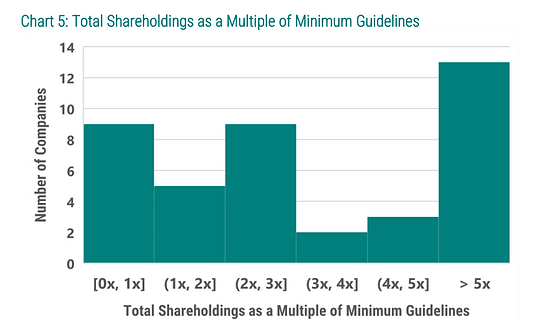

We reviewed the CEO’s total shareholdings as a multiple of minimum share ownership guidelines as calculated by each company’s ownership policies. As summarized in Chart 5, all but nine CEOs have met their minimum shareholdings. In the nine cases where minimum ownership levels have not been met, the CEOs have less than three years in tenure and still have time to comply with the guidelines. In most cases, CEOs tend to have many multiples of “notional” ownership relative to their minimum guidelines.

POTENTIAL ISSUES FOR CONSIDERATION

As part of our deeper review, we analyzed the various share ownership policies along with current holdings across the various instruments that are included within the guidelines. We observe three main issues for consideration:

- The relationship between required share ownership multiple and the instruments that are included in the calculation

- The relationship between LTI grant values and the required share ownership level

- The percentage of ownership that is held in common shares/deferred share units (DSUs) relative to other instruments, such as restricted share units (RSUs), performance share units (PSUs), and/or in-the-money stock options (i.e., “real” v. “notional” ownership)

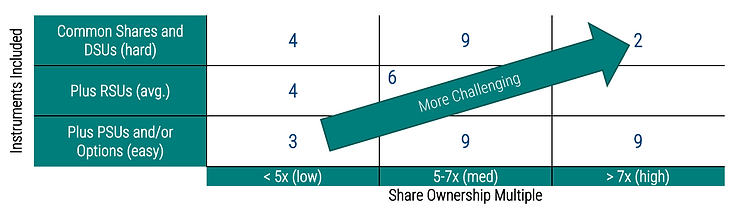

As shown below, it can be hard to compare share ownership multiples, as there are a wide variety of instruments included within the underlying ownership definition which impacts how much real v. notional ownership might be required. This can result in similar multiples being relatively easier or harder depending on the instruments that are included within the calculation.

Some of the examples within the above include:

- CN Rail (top right) – 8x multiple that is met through common share holdings and DSUs

- BCE (top right) – 10x multiple that is met through common share holdings and DSUs, but the CEO has up to 10 years (v. typical 5 years to comply)

- Restaurant Brands (bottom right) – 12x multiple, but have a broad compliance definition that includes RSUs, PSUs and vested options

- BMO, TD, CIBC, RBC, Scotia and Sunlife (bottom right) – 8-10x multiples, but include PSUs in the compliance definition

The second issue is that the share ownership value (denominated as a multiple of salary) does not necessarily keep pace with the value of LTIs. As shown in Chart 6, there tends to be close to a one for one relationship between the value of the LTI grant and the minimum share ownership value (as illustrated by the line), but there are some outliers where the value of the 2020 LTI grant – which may reflect a special award – is significantly higher while the minimum ownership requirement was not adjusted accordingly (for example: Open Text, Gildan and Restaurant Brands).

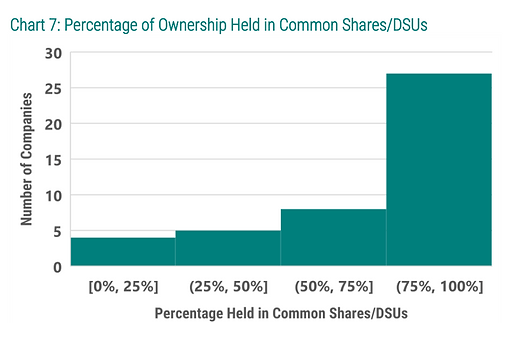

Finally, given the multiple instruments used in defining share ownership, the percentage of total nominal ownership held in common shares / DSUs varies widely. As shown in Chart 7, nine CEOs hold less then 50% of their nominal share ownership in common shares / DSUs, which may overstate actual ownership unless clearly disclosed and understood by stakeholders.

KEY TAKEAWAYS

- Confirm the overarching philosophy to support the design of share ownership guidelines. On one end of the spectrum, compliance with the guidelines can be funded through ongoing equity grants, with the notional value of unvested equity contributing to share ownership. At the other end, ownership is based on personal investments in the organization, with an executive holding common shares, consistent with investors. Based on the philosophy, you can adjust the multiple based on a reasonable ability to comply with the share ownership guidelines based on granted LTIs (both value and mix of LTI vehicles) and on which instruments included in the compliance calculation.

- Consider a retention ratio that requires executives to hold a portion of after-tax gains (e.g., 25-50%) from all long term incentive awards in common shares rather than trying to achieving a minimum multiple of base salary. This allows actual ownership to vary based on the value received from LTIs through an executive’s career which can capture special awards, but can also recognize periods where limited value is received particularly in highly volatile industries

- Require a portion of the minimum share ownership value to be held in direct holdings (e.g., Sunlife requires 25% to be held in common shares and/or DSUs and Pembina requires 50% in common shares) to reinforce the importance of actual ownership. While real ownership is done on an after-tax basis, executives can benefit from preferential tax on subsequent capital gains and dividends which may offset the deferred taxes using DSUs

Interested in learning more about working with Southlea? Click here

Click to view our Service Offerings