In our previous article, we introduced a three-question framework to help private companies navigate the complexities of long-term incentive plan (LTIP) design. From choosing between cash and equity-based plans to selecting the right instruments, we outlined the foundational decisions that shape effective incentive strategies.

In this second instalment, we shift from theory to practice. Through three real-world case studies, we explore how private organizations across different industries and sizes have tackled unique challenges in LTIP design. Whether preparing for succession, driving performance in a turnaround, or scaling a business amid market volatility, each case highlights the importance of strategic alignment, stakeholder engagement, and tailored solutions.

1. Real Equity

Industry: Professional Services

Size: Small (<$50M revenues, <100 employees)

Type: Private Company

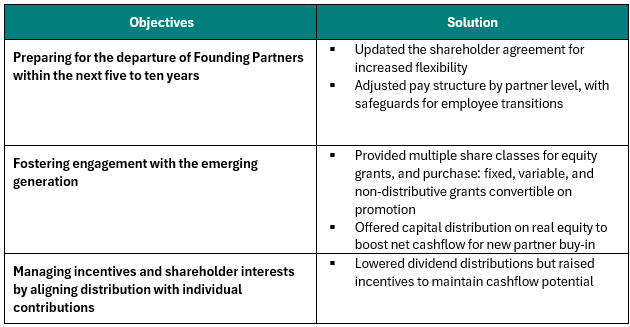

Objectives:

- Managing incentives and shareholder interests by aligning distribution with individual contributions

Our Approach:

- Performed an audit of short-term incentives and the ownership structure

- Incorporated succession planning and retirement considerations

- Developed tax-efficient options and potential trade-offs

- Assessed and communicated possible obstacles and challenges that may arise as the organization develops

Key decision to support a Real Equity Plan: Desire to increase partner ownership

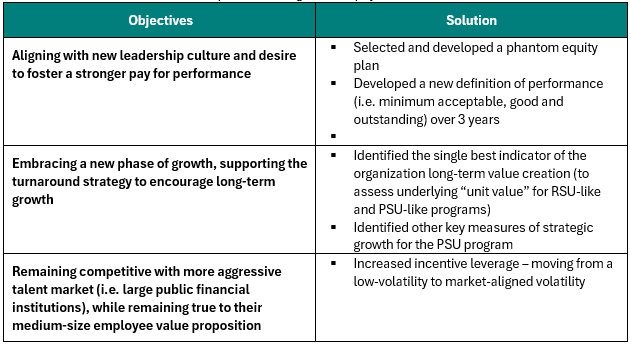

2. Phantom Equity Plan

Industry: Financial Institution

Size: Medium ($100M – $250M revenues, 100-500 employees)

Type: Private Company

Our Approach:

- Conducted a full audit of total compensation offering and incentive plan design

- Reviewed the range of market practice with direct and adjacent talent markets

- Identified the best long-term performance predictors and tested metrics’ volatility based on interest rates, and FX rates

- Modelled and tested stretch performance goals and pay outcomes

Key decision to support a Phantom Equity Plan: Legal structure doesn’t allow to grant ownership.

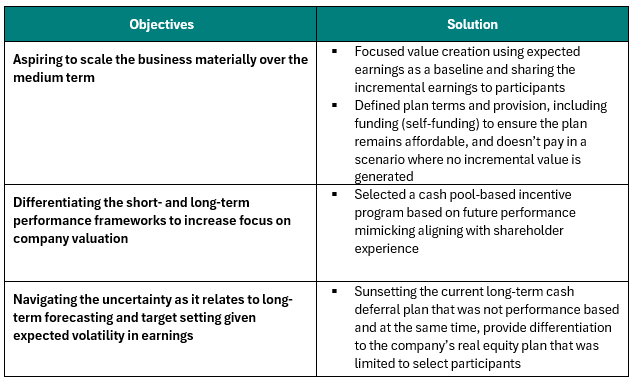

3. Cash Plan

Industry: Energy Services Firm

Size: Medium ( <$100M revenues, 50-150 employees)

Type: Private Company

Our Approach:

- Conducted a full audit of their current pay and incentive plans

- Conducted workshop with key executives to present and explore alternative approaches based on their business strategy

- Modelled and tested alternative approaches based on future five-year forecasts, in contrast with the current incentive plans

Key decision to support a Cash Plan: Executives were already shareholders, and there was too much unknown/ volatility in the medium term.

Conclusion

These three case studies underscore a critical truth: there is no one-size-fits-all approach to LTIP design. Each organization faced distinct challenges—succession planning, cultural transformation, and growth strategy—and required a customized solution that balanced incentive mechanics with business realities.

Key lessons across the cases include:

- Real equity plans can be powerful tools for succession and long-term engagement, especially when paired with flexible ownership structures and thoughtful tax planning.

- Phantom equity plans offer a compelling alternative for mid-sized firms seeking performance alignment without the complexities of real equity.

- Cash-based plans remain highly effective for organizations navigating uncertainty or preferring simplicity, especially when designed to mimic equity-like outcomes.

Ultimately, the success of any LTIP lies in its strategic alignment with business goals, its adaptability to organizational context, and its ability to engage and retain key talent.

If your organization is considering a new incentive strategy—or refining an existing one—our team is here to help. We bring deep expertise in incentive design, tax optimization, and stakeholder communication to ensure your plan delivers lasting impact. Reach out today to explore how we can support your journey.

About The Author

Jean-Francois Malo, Principal

Jean-Francois is a Principal at Southlea Group.

With over 13 years of experience in professional services, including successfully opening and leading the Montreal office at Hugessen Consulting, he joined Southlea Group in August 2023. He is a seasoned consultant having worked with various boards and management teams of many large and mid-sized Canadian companies (both publicly-traded and private).

Pairing his strategy consultant and investor relations backgrounds, he uses his business acumen and hands-on approach to solve business challenges related to compensation, performance management, and governance.

Jean-Francois works across all industries and has specific experience working with asset managers, broader financial services, engineering and technology companies. He also supported clients navigating governance, retention and compensation challenges through liquidity events (e.g. IPO/ M&A).

Holding his CPA, CA designation, Jean-Francois is an MBA graduate from Smith School of Business at Queen’s University. He has also completed his bachelor and a graduate diploma at HEC Montreal. During his time at HEC, he took part in an exchange program to the Hong Kong University of Science and Technology (HKUST).

Jean-Francois is a founding member and President of the Young Leaders Circle of the Pediatric Research Foundation, and a former member of the Executive Committee of the Institute of Corporate Director (ICD) Quebec Chapter and Director Education Program Lecturer.