The Board’s most critical role is the selection and oversight of the organization’s Chief Executive Officer (CEO) given the importance of the role to the long-term success of the organization. The CEO plays a key role in the development and execution the organization’s strategy and a healthy corporate culture. There are also significant risks associated with a poor CEO transition that can impact the company’s reputation and long-term value, along with very tangible financial costs to terminate the former CEO and attract a new CEO into the organization.

As trusted advisors to Human Resources Committees (HRC) across Canada, we wanted to take a closer look at how large Canadian companies (defined as the companies in the S&P/TSX 60 index) manage CEO succession. We analyzed CEO turnover and succession over the past three years (from 2021 to 2023) to gain insights on how well HRCs are managing this process.

Key Takeaways

- Ten percent to 15% of CEOs leave every year, higher than broader employee turnover rates.

- Only 40% leave as a retirement, so most leave for other reasons (another job, poor performance) which is harder to plan and to facilitate a smooth transition.

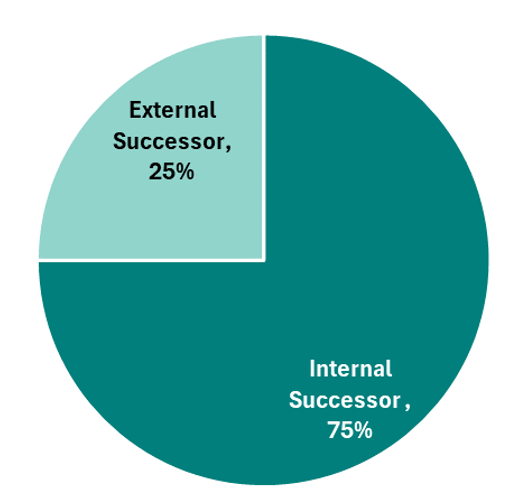

- Despite this, over 75% of CEO replacements are through internal successors, most typically the CFO or COO.

- Average CEO tenure remains stable at seven years, providing some insights to HRCs from a succession planning perspective.

CEO Turnover

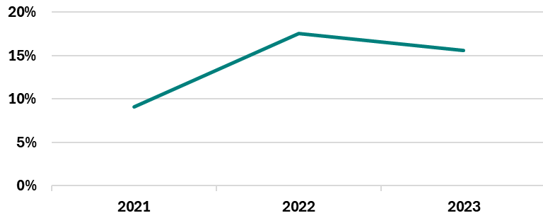

There has been an upward trend in the turnover rates of CEOs, as shown in Figure 1. On an annual basis, 10% to 15% of CEOs within the S&P/TSX 60 have left their companies. This is high when compared to broader employee turnover rates, highlighting the increased risk of the CEO position.

We reviewed the reason for CEOs to leave and found that 40% left because of retirement. Approximately 15% left to pursue other top leadership opportunities and the remaining were not clearly disclosed (e.g., termination due to poor performance, etc.).

Figure 1 – CEO Turnover Trend with S&P/TSX 60 companies

We then reviewed how the departing CEOs were replaced in the organization. As shown in Figure 2, we found that 75% of the CEO successors to fill these vacancies were internally appointed from within the company, while 25% were external hires. This is a good sign of effective succession management, particularly if the timing of the CEO succession is unclear and could be unexpected. Most internal successions held the title of Chief Financial Officer (CFO) or Chief Operating Officer (COO). This again makes intuitive sense as these roles tend to be the next most senior after the CEO and are usually being positioned as potential CEO successors.

Figure 2 – CEO Successor Appointments

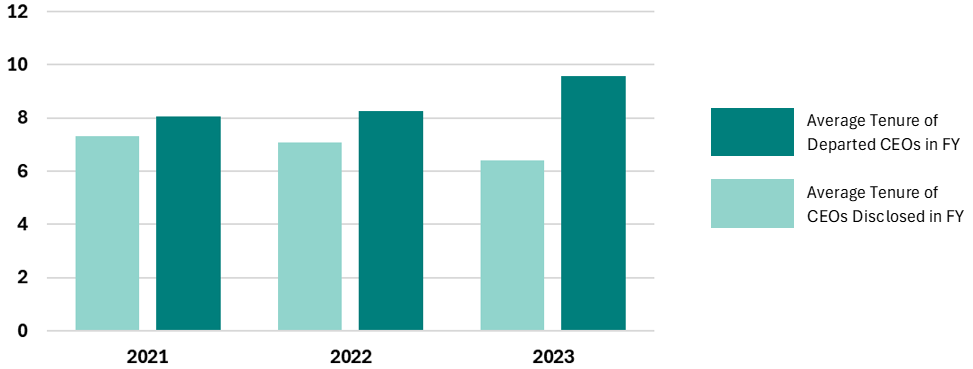

Finally, we reviewed the tenure of CEOs within the S&P/TSX 60 to understand the longevity of the CEO role and to identify any differences between ongoing and departed CEO. As shown in Figure 3, the average tenure of CEOs remains steady at approximately seven years. When comparing this to the tenure of CEOs who departed within the same fiscal year, we see tenure is higher on average among departed CEOs. The lag of average CEO tenure behind the departed CEO average may signal that existing CEOs who are reaching or have already surpassed the seven-year tenure average may be nearing the end of their term. Of the CEOs who departed for reason of retirement, the average tenure is much higher at 14.5 years.

Figure 3 – CEO Tenure of S&P/TSX 60 companies

Best Practices in CEO Succession

There are several compensation-related considerations related to effective CEO succession, including:

- Regular review and monitoring of the CEO’s and executive team’s equity holdings, both their walk-away and leave behind values. This can also raise questions on the definition of the trigger for long-term incentive retirement provisions (e.g., minimum age and service conditions).

- Clear CEO objectives to support an effective CEO transition including the CEO role in developing CEO successors and building a strong executive talent pipeline. This may require clear CEO goals as part of the annual CEO evaluation process and, potentially, direct links to compensation related to the successful advance of the CEO succession process.

- Above-market pay positioning for key CEO successors to minimize potential risk of unexpected departures. This may also include consideration of the potential opportunities for these roles in other organizations and at higher levels (e.g., what could they earn as a CEO or COO within another organization?).

- Consideration of the compensation for other roles in the executive team, particularly potential successors that do not receive the role (i.e., runners-up) and whether they need special consideration to minimize retention risks during a period of transition.

For additional context, our US GECN Partner firm, Farient Advisors, published this article on a “A New Framework for Evaluating Executive Talent Risk.”

About This Author

Sandra Bosnjak, Analyst