The following memorandum summarizes say on pay voting results in Canada (among the TSX Composite companies) and the U.S. (among the S&P 500 companies) based on results released by mid-May 2023.

Canada Results

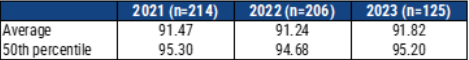

At this point in the AGM cycle, 125 Canadian companies have reported their say on pay results for 2023 (~60% of those that had a say on pay vote last year). We are seeing very similar overall results this year as summarized in Table 1.

Table 1 – Canada say on pay results

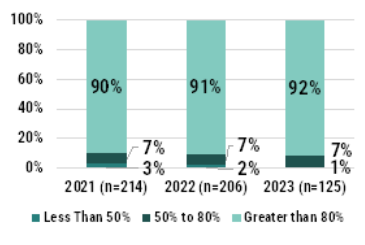

As illustrated in Chart 1, the distribution of say on pay results are generally consistent on a year-over-year basis with 92% of companies receiving over 80% support, 7% receiving 50% to 80% support and 1% receiving less than 50% support (or two companies).

Both ISS and Glass Lewis expect companies to respond to say on pay votes with less than 80% support. This response usually includes some level of shareholder engagement and appropriate changes (such as incentive plan design changes, disclosure improvements, etc.), where warranted.

Chart 1 – Distribution of Canada say on pay results

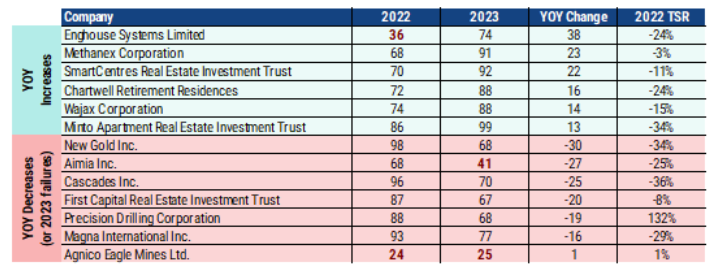

Of the 125 reporting companies, close to 90% of companies reported results that changed less than 10 percentage points on a year-over-year basis. Table 2 summarizes the companies with the biggest year-over-year increases and decreases in their voting levels. We note that most of the companies that experienced a significant year-over-year decrease received support from ISS (“FOR” Say on Pay vote recommendation). So far, only five companies received an “AGAINST” vote recommendation from ISS this year.

Table 2 – Biggest year-over-year changes in say on pay voting results

US Results

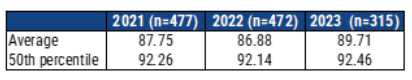

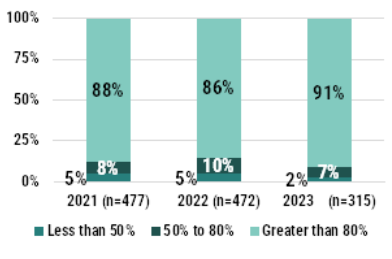

In the US, among the 315 S&P 500 companies that reported as of the middle of May 2023, the average level of support has increased from 87% to 90% (refer to Table 1).

Table 1 – US say on pay results

The percentage of companies receiving greater than 80% support increased to 91% from 86% in 2022.The percentage of companies receiving less than 50% support has dropped to 2% from 5% in 2022 (as summarized in Chart 2).

Chart 2 – Distribution of US say on pay results

Key Insights

For the majority of companies and for the majority of time, the say on pay vote results demonstrate general support from shareholders on the effectiveness of executive compensation programs.

For the majority of companies and for the majority of time, the say on pay vote results demonstrate general support from shareholders on the effectiveness of executive compensation programs.

However, companies can experience a sudden withdrawal of support in any year making it hard to be complacent. Key reasons for lower support include:

- Special one-time compensation awards provided to support a transaction or transformation

- Underperformance resulting in a pay-for-performance disconnect as assessed by the proxy advisors and/or, increasingly, activist shareholders

- Differences in program design relative to standard market practices that might not be fully explained

We advocate for balance against what the proxy advisors and “common market practice” are suggesting to ensure alignment with both your business and talent strategies. This means that companies need to stay on top of the effectiveness of their programs, which includes:

- Continually monitoring the relationship between realized pay and actual absolute/relative performance,

- Adjusting programs as needed to align with your strategy and what is in the best interests of the company, and

- Ensuring that key messages are clearly articulated to shareholders, through regular disclosure and supplemental disclosure or individual meetings as needed

About This Author

Ryan Resch, Senior Partner

Ryan is a founder and Senior Partner of Southlea, a GECN Group company. He has over 20 years of experience consulting complex organizations across North America on executive and broad-based compensation including related governance considerations. He is often the named executive compensation consultant representing either the human resources committee and/or management. Prior to forming Southlea, he worked in Willis Towers Watson’s Toronto and Vancouver offices leading many of the practice’s large client relationships.

He leverages this expertise to bring stakeholders together and drive meaningful change aligned with key business and talent priorities. He is known for providing fresh and innovative thinking with his most recent research focused on connecting environmental, social and governance (ESG) with people and pay programs.