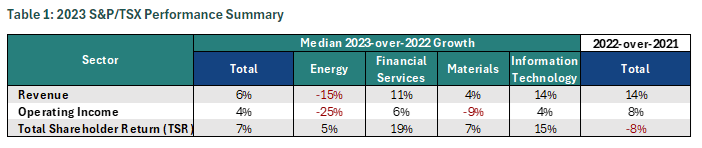

The following summarizes market trends among a sample of “early filers” including thirteen S&P/TSX 60 companies to highlight expected trends through this proxy season. As illustrated in Table 1 for the S&P/TSX Composite, Canadian companies experienced modest growth but better total shareholder returns in 2023 compared to 2022. The energy sector had lower financial results given the impact of commodity prices.

Key Takeaways

- 2023 performance was generally weaker relative to 2022 with revenue and operating income growing by 6% and 4% respectively v. 14% and 8% in 2022. This was offset by stronger TSR in 2023 compared to a more challenging 2022. This level of more modest growth should result in flatter incentive outcomes on a year-over-year basis

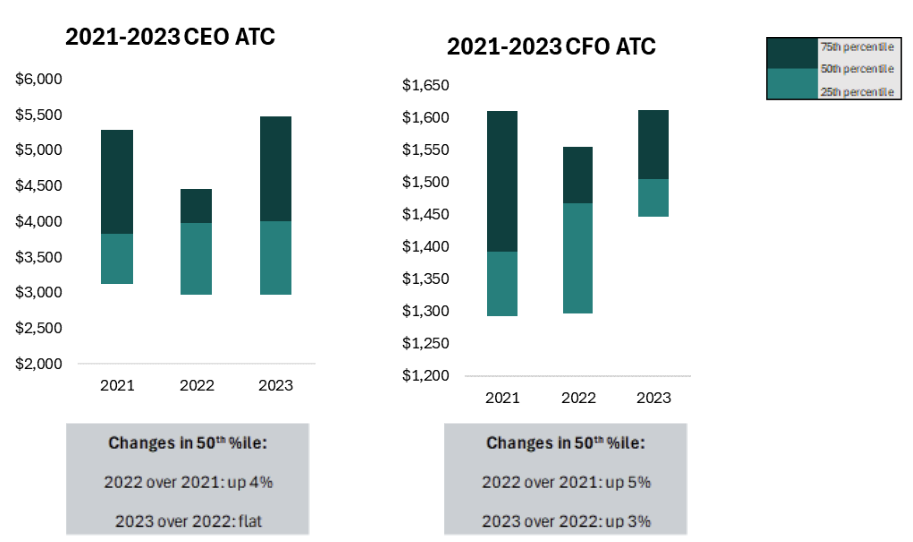

- The median (50th percentile) salaries for CEOs and CFOs remained relatively flat in 2023 (up by 2%) however the 75th percentile is up by 8-11% given a number of increases among higher paid executives

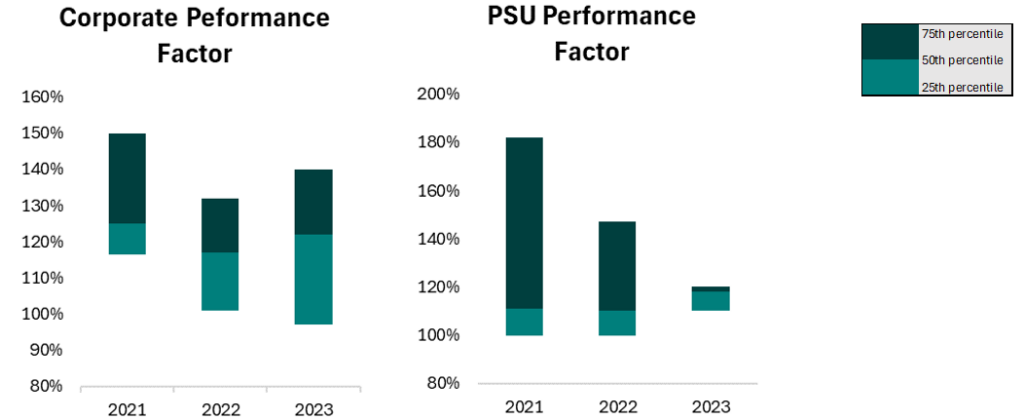

- The performance factors for annual incentives and performance share units (which vested in 2023) remained stable on a year-over-year basis at approximately 1.2x target. Most payouts remain above target in each of the three years which may raise questions on the degree of risk associated with incentives

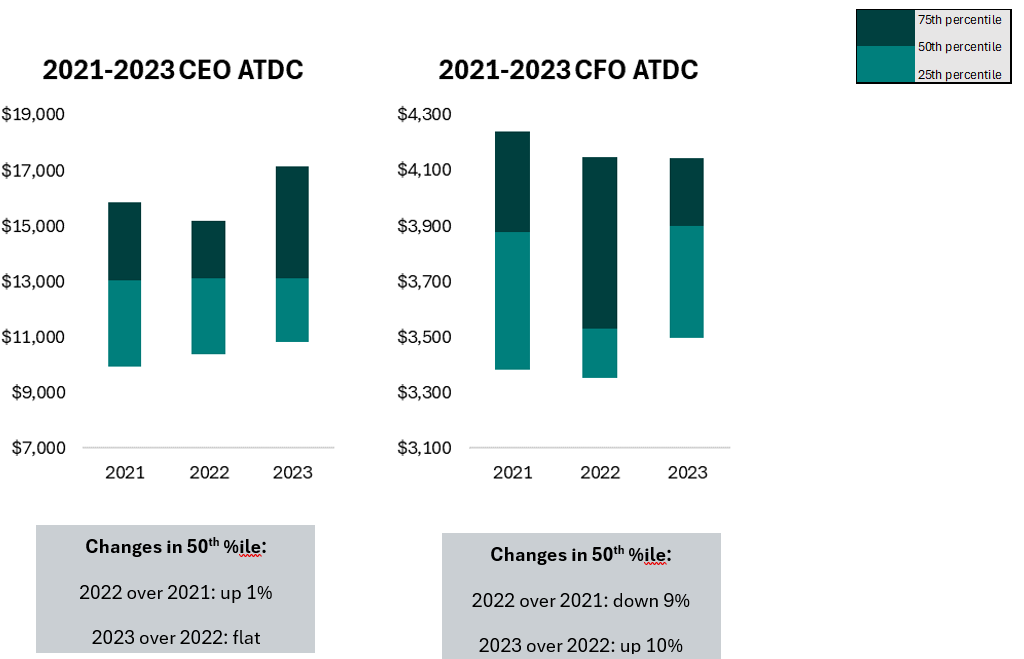

- Actual total direct compensation (ATDC = salary plus actual bonus plus long-term incentives) remained relatively flat in 2023 for CEOs and increased 10% at the 50th percentile for CFOs. The 75th percentile increased by 13% for CEOs suggesting a broader range of compensation outcomes among higher paid CEOs given the increasing global competition for executive talent

- No material changes made to the mix of long-term incentives as companies continue to grant a mix of performance share units, restricted share units and stock options

Market Compensation Trends

The following compensation trends represent actual compensation disclosed over the past three years, including salaries, actual bonuses, and grant values of long-term incentives (all reported in CAD)1. As illustrated in Chart 1, the 50th salaries remained relatively flat over the past three years, increasing by 1-2% per year. In 2023 the range has shifted up with several higher salaries being offered (the 75th percentile is up 8-11%, year-over-year).

[1] We note that this is a change of methodology from prior years as we are expanding the sample beyond companies that had the same incumbent in the role year-over-year.

Chart 1: Salaries

As illustrated in Chart 2, the 50th percentile corporate performance factor in the annual incentive increased slightly in 2023 (from 1.17x target in 2022 to 1.22x target in 2023). The 50th percentile PSU performance factor (for awards vesting in 2023) increased to 1.18x target from 1.1x target in 2022. The range of PSU performance factors also narrowed significantly in 2023 with several companies that had high factors in 2022 reporting lower factors in 2023.

Chart 2: Performance Multipliers

The relatively small changes in the performance factors result in a more modest year-over-year increase in the 50th percentile actual total cash (ATC = salary plus actual bonus) for CEOs of 0% and for CFOs of 3% as illustrated in Chart 3.

Chart 3: Actual Total Cash (ATC)

Actual total direct compensation (ATDC = ATC + long-term incentives) was flat in 2023 for CEOs given more moderate changes in year-over-year long-term incentive awards as illustrated in Chart 4. There was greater variability in CFO pay in 2023 v. 2022 with a 10% change at the 50th percentile (essentially back to 2021 levels).

Chart 4: 2021 and 2022 Actual Total Direct Compensation

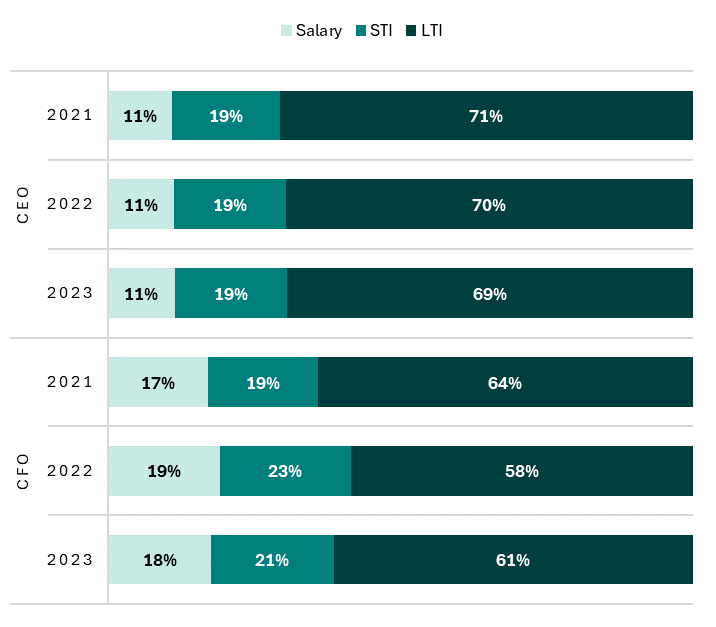

Chart 5: CEO and CFO Pay Mix

Chart 5 summarizes the overall pay mix for CEOs and CFOs which continue to put a majority weighting on long-term incentives (LTI), with short-term incentives (STI) at approximately 2.0x salary for CEOs and 1.25x for CFOs.

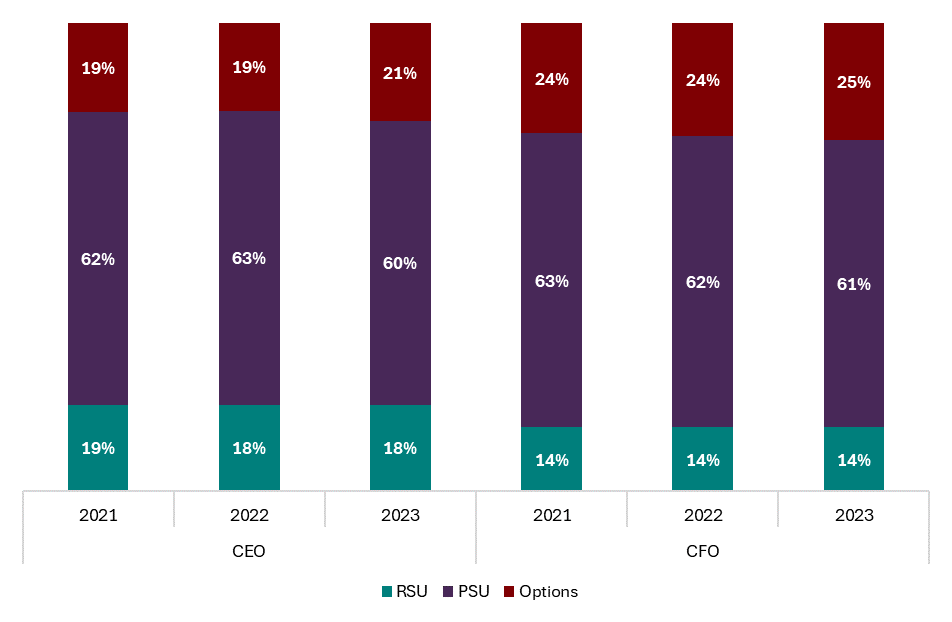

Chart 6: CEO & CFO LTI Mix

The average mix of long-term incentives granted to CEOs and CFOs over the past three years did not materially change, with no structural adjustments made to the use of performance share units (majority weighted), restricted share units (limited usage) and stock options (minority weighted), as summarized in Chart 6.

2024 Expectations

We believe that these preliminary results will translate across the broader market, resulting in more moderate pay changes in 2023 given the growth challenges faced by many Canadian companies. There appears to be more movement at the 75th percentiles which is likely driven by increased competitive pressures for executives outside of Canada, including the impact of a weak CAD:USD exchange rate.

In our 2024 Human Resources Committee Outlook, we summarized our top five predictions for 2024 including more innovative share ownership policies, clarification of adjustments made to measures for incentive purposes, greater quantification of ESG measures, changes to pay v. performance disclosures and pressures on directors’ compensation.

In reviewing the disclosure for these early filers, we observe the following examples of changes to executive compensation:

- CIBC is looking to make further changes to its ESG Index to provide a greater focus on core ESG measures.

- Scotiabank is making several changes to the calculation of the all-bank performance factor including a new combined strategic and competitive modifier and an enhanced risk adjustment.

- Enbridge is increasing shareholder ownership requirements as a multiple of salary and is shifting to one company scorecard by eliminating its business unit scorecards.

About This Author

Ryan Resch, Senior Partner

Ryan is a founder and Senior Partner of Southlea, a GECN Group company. He has over 20 years of experience consulting complex organizations across North America on executive and broad-based compensation including related governance considerations. He is often the named executive compensation consultant representing either the human resources committee and/or management. Prior to forming Southlea, he worked in Willis Towers Watson’s Toronto and Vancouver offices leading many of the practice’s large client relationships.

He leverages this expertise to bring stakeholders together and drive meaningful change aligned with key business and talent priorities. He is known for providing fresh and innovative thinking with his most recent research focused on connecting environmental, social and governance (ESG) with people and pay programs.