As the mining sector continues to experience significant growth in commodity prices, executive compensation has seen a modest uptick, driven largely by rising short-term incentive levels.

Southlea reviewed the compensation data for the 41 companies in the metals and mining industry sector. The compensation outcomes of 2024 occurred against a backdrop of extremely strong financial and market performance (at median, of companies reviewed):

- Revenue growth reached 21% for the year

- EBITDA grew by 38%

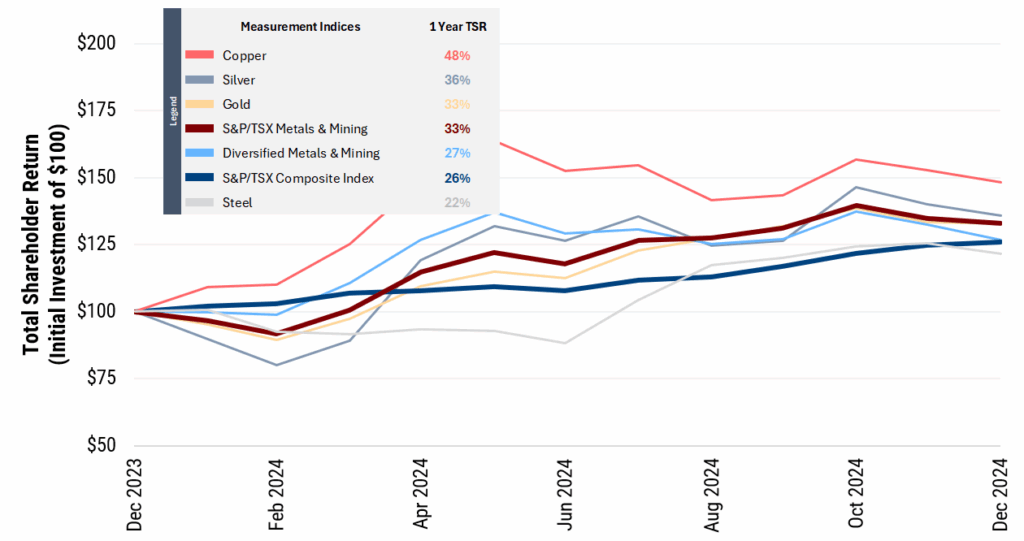

- Total shareholder return (TSR) was +22% for the year and +48% for the past three years, with a fair degree of variability by commodity/sub-sector

The enterprise value for the companies reviewed ranged from $2.9B at the 25th percentile to $15.0B at the 75th percentile, capturing a broad range of compensation levels and practices within the mining sector.

In this analysis, we reviewed CEOs and CFOs who were in role for the past two fiscal years. Doing so allows us to isolate changes in compensation, rather than an evolving mix of incumbents and / or companies in the sample. We reviewed results from the mining sector in aggregate, rather than reviewing subsectors, as the sample size of most subsectors was insufficient to draw implications from.

Salaries and Incentives Continue to Climb

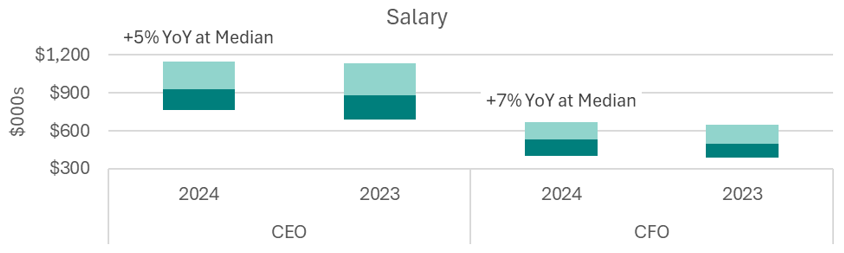

Base salaries for top executives increased with the 50th percentile of CEO and CFO compensation increasing by 5% and 7% respectively. The median salary increase was 6-7%, with 32% of incumbent CEOs receiving an increase of 10% or greater and 25% of incumbents not receiving an increase.

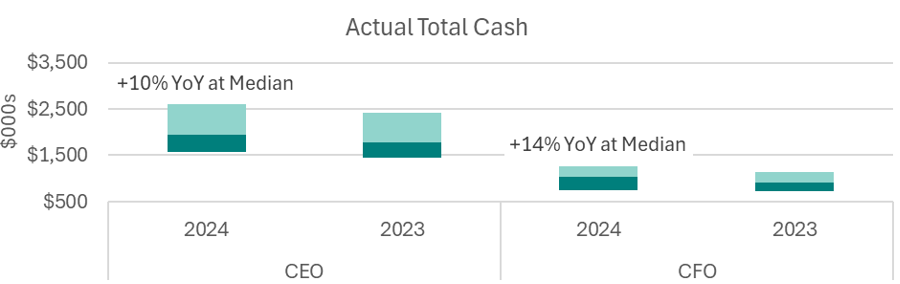

Actual Total Cash Compensation (salary plus actual 2024 bonus) grew strongly for same incumbents, with CEOs growing by 9% at median and CFOs growing by 15%. These trends reflect a continued shift to incentives as the primary driver of compensation increases and higher bonuses on a year-over-year basis.

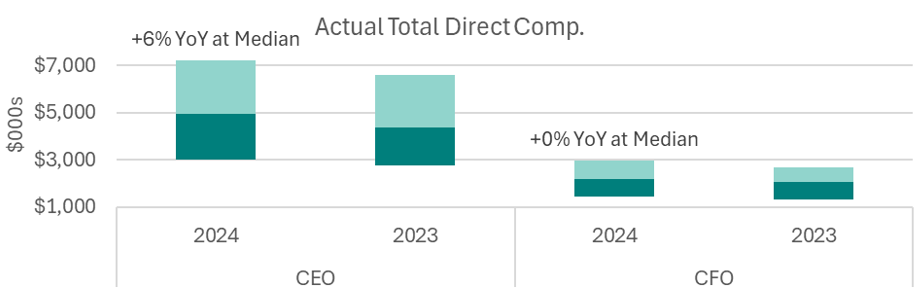

Actual Total Direct Compensation (salary plus actual 2024 bonus plus 2024 long-term incentive grant) did not change as much, with the increase in cash compensation (salary and bonus) offset by lower long-term incentives.

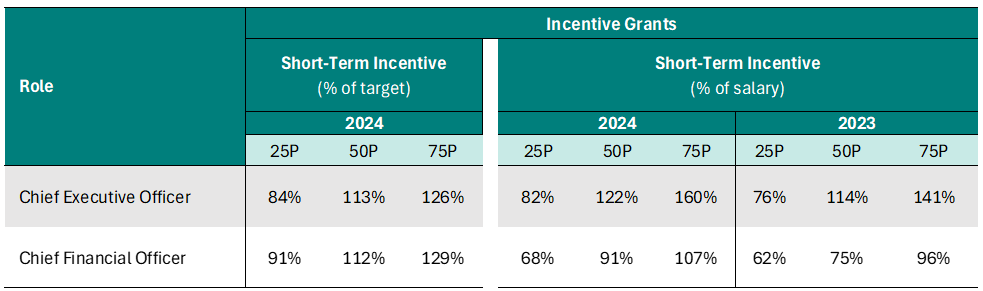

Bonus Payouts Exceed Targets

Actual short-term incentive (STI) payouts (as a percentage of salary) increased, at median, from 114% in 2023 to 122% in 2024, while, for the CEO, the median payout was 113% of target.

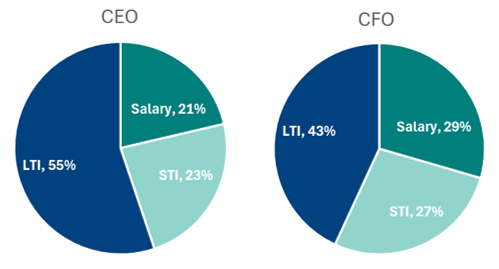

Pay Mix: Long-Term Focus

Executive pay remained consistent in 2024, with CEO compensation consisting of 21% salary, 23% short-term incentives, and 55% long-term incentives. CFOs generally received a greater proportion as fixed salary, making up 29% of their pay, alongside 27% from short-term incentives and 43% from long-term incentives. In most cases, higher overall compensation tends to be associated with a larger percentage of variable pay.

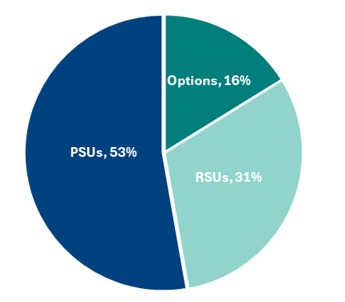

Long-Term Incentive Mix

For long-term incentives (LTI), performance share units (PSUs) continue to take center stage, reflecting 53% of the LTI mix, with restricted share units (RSUs) and stock options reflecting the remaining 31% and 16%, respectively.

Total Shareholder Return (TSR) remains the main metric for evaluating Performance Share Units (PSUs), with 92% of companies using it. Production metrics appear in 19% of plans, and both strategic objectives and return metrics are used by 16% of companies each. Most organizations use several performance measures: only 45% focus exclusively on TSR. Southlea suggests using a mix of metrics for thorough measurement and to avoid unintended results. While Relative Total Shareholder Return covers many areas, diversifying metrics helps address possible issues, such as differences in how companies operate or handle risk compared to their peers.

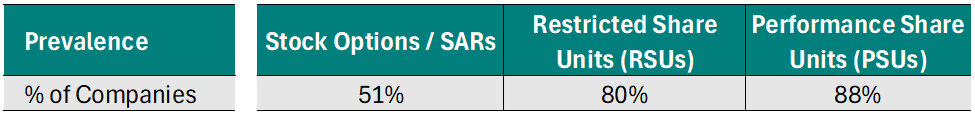

Reviewing the prevalence of vehicles in companies’ LTIs, PSUs are used at 88% of companies, RSUs are used in 80% of plans, while Stock Options are used in 51% of LTI plans. 78% of companies studied use more than one vehicle.

What This Means for the Mining Sector

The trend toward utilizing RSUs and PSUs continues, with PSU plan designs undergoing ongoing adjustments. Due to the complexities of establishing multi-year PSU targets, certain organizations are increasingly considering time-based equity awards such as RSUs that incorporate extended vesting periods (for example, five years) and post-exercise holding requirements. These methods foster robust, long-term alignment with shareholder interests and offer greater administrative simplicity compared to traditional PSUs. Such compensation strategies are particularly well-suited to mining companies, which typically operate on lengthy capital cycles and are subject to considerable commodity price volatility.

Moreover, there is growing adoption of absolute shareholder returns as a key performance metric among mining firms, reflecting a shift away from prior emphasis on growth-oriented measures.

In addition, we continue to see an evolution in the design of STI plans with continued simplification and focus on key financial and operating drivers. It is always more complicated within a commodity-cyclical business to create alignment with shareholder given commodity price variability with operating measures that are more fully within control of management; however, greater alignment on key areas of focus improves the effectiveness of the STIP making each measure more meaningful from a participant’s perspective.

Looking forward, we expect salary increases for 2026 to be moderate for executives within the mining sector, with salary increase budgets around 3% (based upon Southlea’s Compensation Planning Survey released in October 2025).

About The Author

Tanner Woods, Senior Analyst

Tanner is a Senior Analyst at Southlea Group.

He has two years of experience providing analytical support on executive and broad-based compensation projects.

He has experience supporting companies with a broad amount of compensation initiatives, including broad-based structure development, peer group development and competitive benchmarking of board members and executives.

Tanner has experience working across various sectors, including oil & gas, mining and asset management.

Tanner holds a Bachelor of Arts, Honours Business Administration with distinction from the Ivey Business School at Western University and the chartered financial analyst (CFA) designation.