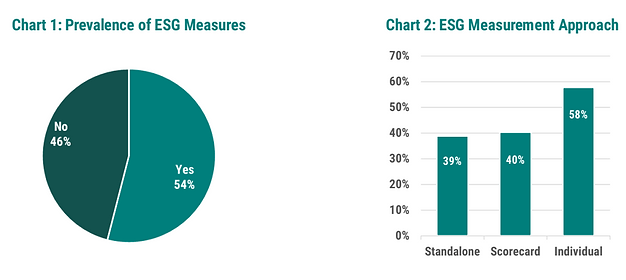

The use of Environmental, Social and Governance (ESG) measures within incentive plans continues to increase in prevalence in response to pressures from various stakeholders. Based on research conducted by Southlea and ESG data analytics firm ESGAUGE (refer to Chart 1), we found that 54% of S&P 500 companies disclosed the use of an ESG measure within their incentive arrangements in 2021 (we note that data on Canadian companies is currently being compiled). As summarized in Chart 2, ESG measures can be incorporated as a standalone metric (39% prevalence), within an overall business strategy scorecard (40%) or within individual performance assessments (58%).

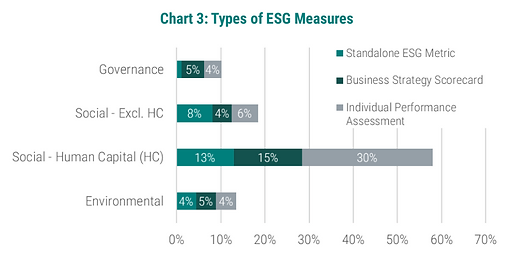

The most common standalone metrics are operational such as customer service and employee health and safety (refer to Chart 3) – these measures have a history of being included within incentive plans. ESG measures within an overall scorecard and / or individual performance are most often qualitative in nature with new measures being added relating to diversity and inclusion strategies. Going forward we anticipate greater use of standalone ESG metrics – such as specific diversity targets (related to overall representation, hiring and/or retention) – that are measurable and formulaic, like other financial and operational measures currently included within incentive plans.

Issues Adopting ESG Measures

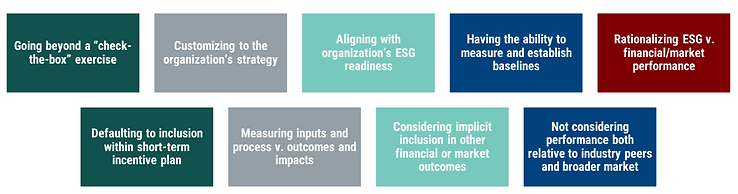

In our experience, market practice is interesting, but not necessarily helpful as it reflects past practice which is quickly outdated with current and emerging practices. Beyond the challenges of keeping pace with market practice, we are finding that companies are facing several discussion points when incorporating ESG measures within their incentive plans.

ESG Incentive Design Principles

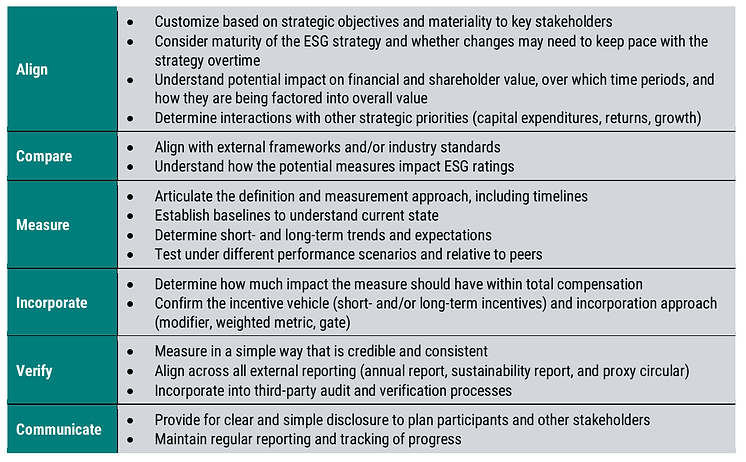

While we believe that ESG and climate change are important considerations, ESG strategies vary significantly between industries and between companies within an industry. To support the incorporation of ESG measures into incentive plans, the following incentive design principles can support the decision-making process:

Climate Change Examples

We anticipate that companies will focus on the ESG measures that need to change overtime and climate change is a good example where we have seen numerous commitments to a “net-zero” target by 2050, with intermediate emissions reduction targets by 2030. While most companies have adopted ESG measures within their short-incentive plan (STIP), we anticipate that many climate change measures might be better suited in the long-term incentive plan given the timeframes required to make meaningful change. For example, if it is a longer-term target and/or progress will take many years (e.g., GHG reduction, workforce diversity), it may make sense to include as a 3-year target within the performance share unit (PSU) plan. In other cases, long-term incentives represent a greater proportion of total incentive pay, particularly for executives, and a 10% allocation in PSUs is more meaningful than 10% in the STIP.

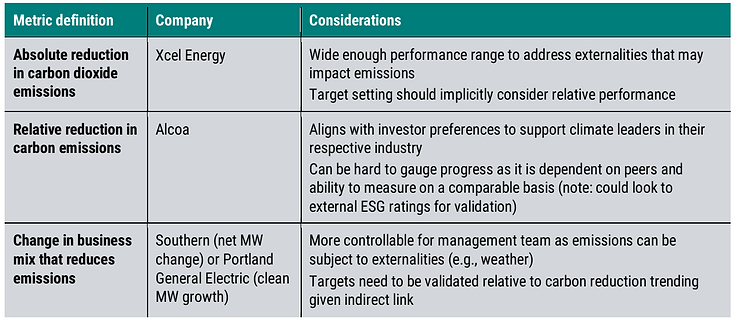

We identified 22 companies in the Russell 3000 using some type of carbon footprint measure. Seventeen companies put this measure in the STIP with an average weighting of 7.5% and five companies put the measure in the long-term incentive plan (typically performance share units or PSUs) with weightings between 10% to 35%. Based on those that use PSUs, we provide examples below of different ways for its inclusion:

Finally, there might be an opportunity to add a new/separate incentive plan that is customized to the specific ESG measure. For example, if you have a 10-year emission reduction target, it might make sense to adopt a 10-year PSU plan that is directly aligned with this target. This approach addresses concerns about how the target will be achieved during the interim periods and reinforces the importance of its achievement. While ten years is longer than most executives may want, there are ways to provide for payment to those retiring or leaving on good terms before the end of the period. In addition, companies will need to determine whether this additional incentive is carved-out of current compensation or is in addition given the importance of the ESG metric and alignment with incremental value creation.

Alternatively, some are advocating that strong performance supporting climate change through lower emissions will drive long-term share price returns, so might be better addressed in longer-vesting shares with post-employment hold periods. In the end, a combination of approaches may need to be taken depending on your ESG strategy, degree of maturity and current priorities.

Review our 2024 Global Trends in ESG Incentives: Entering the Next Phase of Maturity report here.

Interested in learning more about working with Southlea? Click here

Click to view our Service Offerings