Key Takeaways

- We are all adapting to the “new normal” shareholder engagement on executive pay topics – proxy advisors (ISS and Glass Lewis) and institutional shareholders have specific views on executive pay that we cannot ignore

- We expect opinions will continue to evolve – it will be important for issuers to monitor the voting guidelines of their largest investors, and to tailor communications and disclosure to address perspectives as needed

- Issuers should define their approach to shareholder engagement which may include meeting directly with investors to discuss executive pay topics, and providing supplemental disclosure (proactive or reactive) to explain pay design details or decisions where investors flag concerns

- Unique perspectives on executive pay topics by proxy advisors or select institutional investors:

- Support for disclosure of total pay levels that could be received under different performance scenarios

- Against vesting of PSUs when relative performance is below median

- Against short performance period for the PSU design, less than three years

- Support for equity vehicle term to maturity of 5 years or less

- Support for higher annual utilization (burn rate) of shares

- Against total pay of any named executives >200 times the average annual wage in the country

Context

To the middle of June, Say on Pay results in Canada are consistent with past years, with average support of 92%. In many ways this has been a typical proxy season, but behind the scenes, the process to prepare for the annual investor vote has never been more challenging.

Consistent with past years, voting results are dependent on the views of institutional investors. Historically, proxy advisors Institutional Shareholder Services (ISS) and Glass Lewis have been a primary influence on investor voting – these groups evaluate an issuer’s executive pay program and disclosure and recommend whether an investor should vote “For” or “Against” Say on Pay. Over time, institutional investors have developed an independent point of view, documented in voting guidelines for Say on Pay (and other governance topics).

The disclosure of these guidelines has helped issuers understand investors’ perspectives.

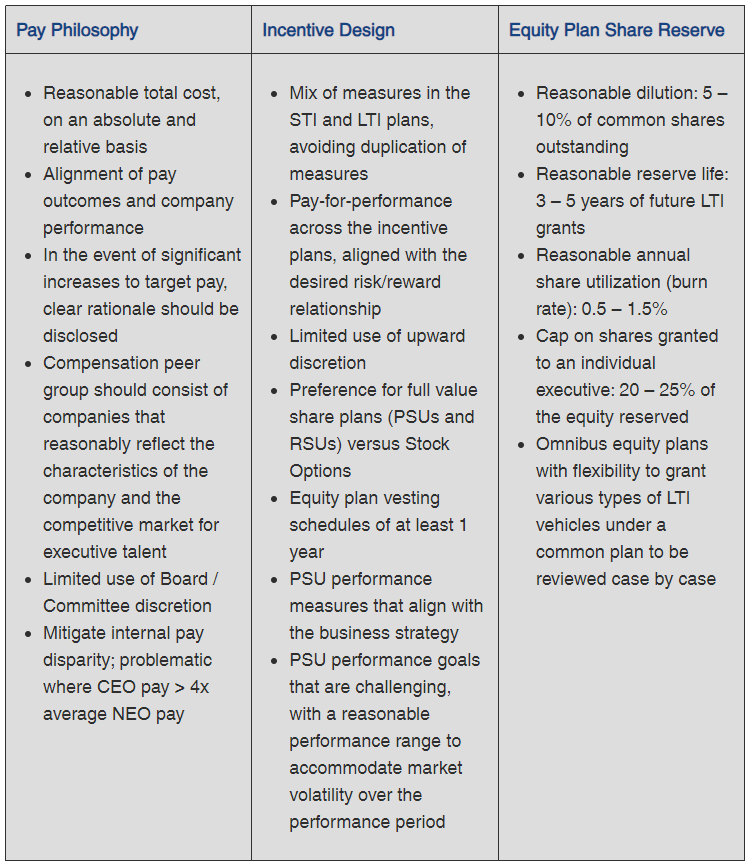

But the different views across investors and proxy advisors have added complexity. While there is general agreement on many executive pay topics, there are differing views on others. Below we summarize areas of consensus and discuss in more detail some of the unique perspectives disclosed.

Consistent Preferences, by Theme

Unique Perspectives on Select Topics

In reviewing current voting guidelines among large institutional investors and proxy advisors, we note the following perspectives which are different from the common view, and different typical Canadian practices.

Support for disclosure of total pay levels that executives could receive under different performance scenarios [BMO Global Asset Management]. The Compensation Discussion & Analysis section of the Management Information Circular typically reviews pay levels from a couple perspectives. This includes “target” incentive pay when expected levels of performance are achieved over various time horizons, “actual” incentive pay with the value of bonuses paid for annual performance, and the grant date fair value of long-term incentives. Some companies will also summarize the value of “realizable” pay, with the current value of longer-term incentives based on share price performance. This voting guideline encourages another lens, summarizing potential pay outcomes under different performance scenarios (additional details were not provided).

This voting guideline highlights the different ways that investors will evaluate pay programs and the relationship with performance results. In this case, BMO Global Asset Management may be interested in the possible range of pay outcomes to understand pay volatility, or they may be trying to determine the “maximum” value of incentive compensation. Outside of North America, organizations will often express performance as a percentage of maximum (maximum plan), rather than a percentage of target used in Canada. The voting guideline may help to compare pay programs across different regions.

Against vesting of PSUs when relative performance is below median [Glass Lewis]. In PSU plans, relative total shareholder return (TSR) is the most common measure, with performance evaluated in a range around a market index, or around the median of a specific peer group. It is nearly universal practice in Canada to provide partial vesting (50 – 100%) for performance moderately below the index, or peer group median (e.g., >90% of the index, or >30th percentile of a peer group). Where Canadian companies have a relative TSR design, Glass Lewis commonly criticizes this performance calibration. Their preference is to set threshold performance equal to the index, or the peer group median, with 0% vesting if relative performance falls below this threshold. This calibration is consistent with common practice in the United Kingdom (UK) which may be the inspiration for Glass Lewis. But the UK market has different norms for incentive plan designs, with PSU performance scores calibrated as a maximum plan (i.e., performance equal to an index would score 50% of maximum in the UK, vs. 100% of target in Canada).

This voting guideline illustrates investors’ interest in target and range setting, and the importance of disclosing the process followed and the rationale for performance calibration. Although majority market practice in Canada is different from the preferred design by Glass Lewis, we are closely monitoring investor sentiment on this topic – with pay-for-performance continuing to be a focus, a higher performance hurdle for 100% vesting could be on the horizon.

Against short performance period for the PSU design, less than three years [Glass Lewis]. Also in PSU plans, the common performance period is 3 years. But in some cases, companies will review performance for discrete periods within a 3-year timeframe (i.e., performance in year 1, year 2, year 3 and over 3 years, with the overall vesting score based on a weighted average of the various periods). Glass Lewis views these multi-period designs as “shorter-term” and a problematic pay practice, regardless of the circumstance or rationale for the design.

This voting guideline reinforces investors’ interest in mid-term / longer-term performance, with a period less than 3 years considered to be “shorter-term”. Issuers could view this perspective to be specific to Glass Lewis, noting that other investors do not criticize this PSU design. However, Glass Lewis suggests their voting guidelines reflect the sentiments of investors, collected through annual surveys and direct feedback, and therefore their views cannot be ignored.

Support for equity vehicle term to maturity of 5 years or less [BCI, OMERS and OTPP]. There is a traditional view that an equity plan with a longer time horizon is better, and more aligned with investor preferences. Counter to this view, voting guidelines of a few prominent investors prefer equity vehicles, including Stock Options, to have a term of 5 years or less. This could suggest investors’ definition of “long-term” is shrinking. It could also suggest investors are increasingly focused on share overhang, preferring a faster time frame to settle outstanding awards, particularly if Stock Options are underwater and providing no benefit to the company or participants. The impact of a shorter term can be meaningful. While shares may recycle faster, the grant date value of a Stock Option will likely decrease (shorter time period to realize value), with the potential for higher levels of dilution to deliver a market competitive dollar value.

This voting guideline presents an opportunity for issuers to review the settlement periods of all equity vehicles, and the weighted average term applying the equity mix, e.g., a common LTI mix includes 3-year PSUs and 3-year RSUs with majority weight (75% or more in many cases), results in an average term closer to 3 years vs. 4+ years historically. One design concept to extend the average term is longer-vesting RSUs, e.g., over 4 or 5 years, particularly where RSUs are replacing Stock Options. This design would require settlement of RSUs from a shareholder-approved reserve, which is nearly always supported by investors, particularly if the request is to repurpose the reserve already approved for the Stock Option plan.

Support for higher annual utilization (burn rate) of shares [CDPQ]. Generally, voting guidelines are specific on the level of annual utilization that is acceptable (varies from <1%, 1 – 2%, or <2%). CDPQ cites a preference for annual utilization <1%, but will support 1 – 2% where one of the following criteria are met: (i) the equity plan is open to a broader number of managers / employees, (ii) the company is in a “start-up” or “growth” phase and needs to preserve cash, (iii) the company is the result of a merger in which different equity programs are being combined, or (iv) the company’s pay philosophy is below market and equity grants are necessary as a form of performance incentive.

This voting guideline demonstrates thoughtful flexibility to consider an issuer’s circumstance; it also encourages transparent disclosure on the details and rationale for equity plan decisions, particularly if the absence of those details may trigger investor concerns.

Against total pay of any named executives >200 times the average annual wage in the country [SHARE]. When benchmarking compensation, the typical approach is to compare executive pay to a sample of comparable companies. The peer group may be defined by organization structure, industry, size and/or other considerations. An alternative approach is to review executive pay using ratios, comparing to the median or average employee in the organization, or in the case of this voting guideline, a multiple of the average annual wage in Canada. SHARE has stated a preference for capping executive pay at up to 200 times. For 2022, Statistics Canada reported the average annual wage for full time employees was $69,350. So, SHARE’s cap on executive pay would be $13,870,064 ($69,350 x 200).

This voting guideline illustrates another lens for assessing the reasonableness of executive pay. Peer group comparison is one approach (sometimes called “horizontal” benchmarking”) which can be complemented by ratios (or “vertical” benchmarking) to have a full perspective on the optics of executive pay.

About This Author

Alex Pattillo, Partner

Alex is a founder and Partner of Southlea, a GECN Group company. For the past 15 years, Alex has advised boards and senior management teams on aligning pay programs with their business strategy and performance objectives. He has worked with many of the largest companies in Canada, with international and global operations. He is known for his expertise in executive compensation governance, including public disclosure requirements, and understanding the perspectives of institutional investors and proxy advisors (such as ISS and Glass Lewis) in Canada.

Prior to forming Southlea, Alex worked at Willis Towers Watson, a global human resources consulting firm, as the market leader for the Toronto Rewards Practice and the leader of the Canadian Executive Compensation Governance Team.