Although private companies typically lack access to information regarding their peers’ compensation plans, HR committees and executives have the privilege and increased flexibility to design plans that align with their specific business objectives.

Designing a long-term incentive plan (LTIP) can appear as complex as managing the controls on a Boeing-737 dashboard, with numerous levers, switches, buttons, and indicators—making it challenging to identify where to begin. This article introduces a three-question framework intended to guide you through the process of long-term incentive design, enabling you to evaluate the most commonly available options, along with their respective benefits and challenges.

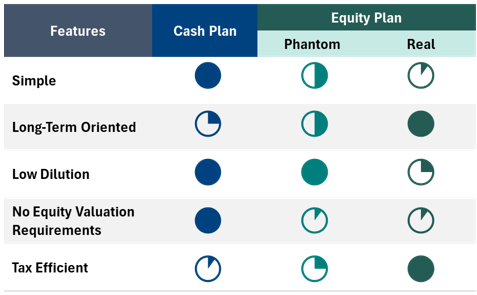

Equity plans are tied to a Company valuation, while cash plans are not

Step 1: Cash VS. Equity Plans

Companies must first determine their priorities and rationale for the LTIP before determining the form it will take. Cash plans are often praised for their simplicity and focus on near-term impact, while equity plans can foster a deeper sense of investment and commitment, albeit with greater complexity. In addition to considering business fundamentals such as specific talent market dynamics, succession planning, and exit or IPO strategies, discussions with key stakeholders should help determine the most appropriate outcome. This process will assist in identifying where to start.

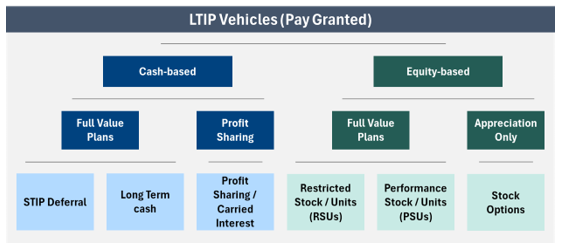

Step 2: Selecting the proper instrument

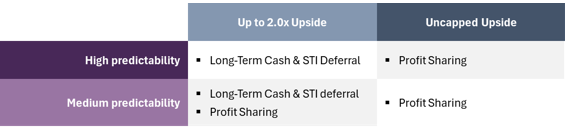

Cash Instruments

Limited by the Canadian Salary Deferral Rules, these instruments are typically limited up to three years

- Long-Term Cash / STI Deferral: Cash incentive promise made upon achievement of specific objectives. Payment made at the end of the agreed performance period.

- Profit Sharing: Cash incentive determined as a pool established by a fraction of a key financial indicator over the defined period.

It is generally observed that large and established private organizations implement long-term cash or STI deferral programs. This solution is straightforward (particularly given current rigid equity-plan regulations), serves as an excellent alternative for entities without cash constraints, and aligns with a low- to medium-risk appetite.

Conversely, a profit-sharing plan is more appropriate for partnerships or service-based companies where success is predominantly tied to annual earnings figures, preferably where there is minimal capital expenditure and investment required. It is crucial for organizations to recognize that this solution necessitates close monitoring, as the objective is for earnings to increase at a faster rate than compensation.

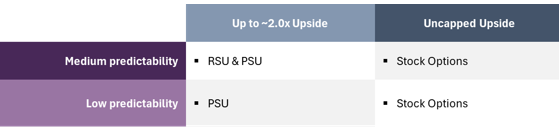

Equity Instruments

Limited by the Canadian Salary Deferral Arrangements (SDA), phantom-equity instruments (cash-denominated incentives) are typically limited to a term of up to three years (unless in option form, with a substantial risk of forfeiture). The vesting of true equity plans can stretch past 3 years (no limit on term) and are subject to a different section of the tax act.

- Performance Share-Units (PSU) & Restricted Share Units (RSU): Incentive is granted in units/ shares (at the outset), and would typically pay upon vesting (RSU) which could subject to a performance modifier (PSU) and at the equity value at time of payment

- Stock Options: Incentive is granted in units (with a specific strike price), and vests over the agreed period. Upon exercise, the participant value represents the spread between the latest equity value and strike price

RSU (or PSU) plans are ideally suited to large private companies, later-stage private equity arrangements, or scenarios involving executive-owner succession planning. Although they are more complex to establish and administer, these plans provide excellent alignment with shareholders, moderate risk appetite, and advantageous tax treatment.

Conversely, stock options are highly effective for firms with significant growth potential, where investors aim for substantial returns (e.g., early-stage, VC-backed organizations). This instrument fosters strong alignment to both performance outcomes and exercisability, which is connected to an anticipated liquidity event.

Summary Table

Learn more about incentive design and mechanics in our ICD-toolkit and follow along for our upcoming series of case studies, outlining real-world examples of private companies implementing new LTIPs.

Whether you’re considering RSU or PSU plans for executive-owner succession planning or stock options for fostering alignment in high-growth, VC-backed scenarios, our experts are ready to help navigate the complexities and ensure optimal outcomes tailored to your organization’s needs. Reach out today to chart the best path forward.

This article provides a high-level overview and does not encompass all the nuances associated with various types of private organizations, including instrument-specific features, regulatory limitations, and tax implications. We invite your team to connect with us for personalized guidance.

About The Author

Jean-Francois Malo, Principal

Jean-Francois is a Principal at Southlea Group.

With over 13 years of experience in professional services, including successfully opening and leading the Montreal office at Hugessen Consulting, he joined Southlea Group in August 2023. He is a seasoned consultant having worked with various boards and management teams of many large and mid-sized Canadian companies (both publicly-traded and private).

Pairing his strategy consultant and investor relations backgrounds, he uses his business acumen and hands-on approach to solve business challenges related to compensation, performance management, and governance.

Jean-Francois works across all industries and has specific experience working with asset managers, broader financial services, engineering and technology companies. He also supported clients navigating governance, retention and compensation challenges through liquidity events (e.g. IPO/ M&A).

Holding his CPA, CA designation, Jean-Francois is an MBA graduate from Smith School of Business at Queen’s University. He has also completed his bachelor and a graduate diploma at HEC Montreal. During his time at HEC, he took part in an exchange program to the Hong Kong University of Science and Technology (HKUST).

Jean-Francois is a founding member and President of the Young Leaders Circle of the Pediatric Research Foundation, and a former member of the Executive Committee of the Institute of Corporate Director (ICD) Quebec Chapter and Director Education Program Lecturer.