The following memorandum summarizes say on pay voting results in Canada (among the TSX Composite companies) and the U.S. (among the S&P 500 companies) based on results released by mid-May 2022.

CANADA RESULTS

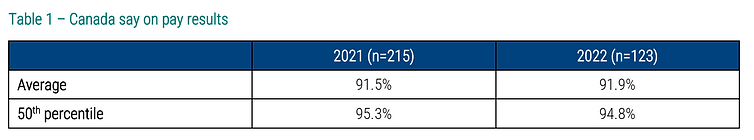

At this point in the AGM cycle, 123 Canadian companies have reported their say on pay results for 2022 (57% of those that had a say on pay vote last year). We are seeing very similar overall results this year as summarized in Table 1.

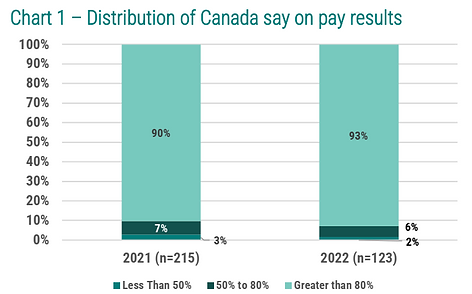

As illustrated in Chart 1, the distribution of say on pay results are consistent with 93% of companies receiving over 80% support, 6% receiving 50% to 80% support and 2% receiving less than 50% support.

Both ISS and Glass Lewis expect companies to respond to say on pay votes with less than 80% support. This response usually includes some level of shareholder engagement and appropriate changes (such as plan design changes, disclosure improvements, etc.), where warranted.

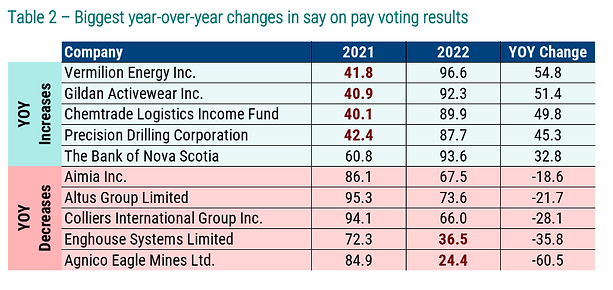

Of the 123 reporting companies, close to 90% of companies reported results that changed less than 10 percentage points on a year-over-year basis. Table 2 summarizes the top five companies with the biggest year-over-year increases and decreases in their voting levels.

US RESULTS

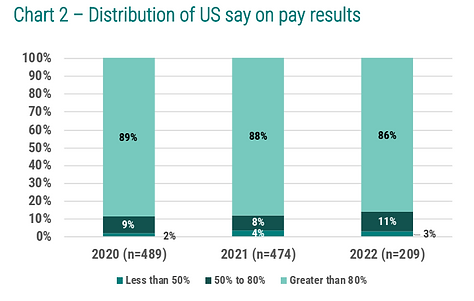

In the US, among the 209 S&P 500 companies that reported as of the middle of May 2022, the average level of support has decreased with the percentage of companies receiving greater than 80% support decreasing to 86% from 88% in 2021 (sourced from: https://farient.com/insights/say-on-pay-tracker/). The percentage of companies receiving less than 50% support has remained generally consistent at around 3-4% (as summarized in Chart 2).

KEY INSIGHTS

- For the majority of companies and for the majority of time, the say on pay vote results demonstrate general support from shareholders on the effectiveness of executive compensation programs

- However, companies can experience a sudden withdrawal of support in any year making it hard to be complacent, particularly if there is under performance and/or unique situations

- In some instances, low say on pay votes have resulted in more clarity of reporting or tightening up of program design to enhance the pay for performance alignment

- There are also ongoing challenges between how pay is set and what is actually realized relative to performance given how pay is disclosed and then assessed relative to performance by the proxy advisors

- We advocate for balance against what the proxy advisors and “common market practice” are suggesting to ensure alignment with both your business and talent strategies. This means that companies need to stay on top of the effectiveness of their programs, which includes:

- Continually monitoring the relationship between realized pay and actual absolute/relative performance,

- Adjusting programs as needed, and

- Ensuring that key messages are clearly articulated to shareholders

Interested in learning more about working with Southlea? Click here