Background

As we look forward to 2023, we reflect upon the various factors that are expected to have an impact on Human Resources (HR) Committee workplans in Canada. Through 2022, we saw:

- A confluence of various market factors including lower share prices, higher inflation, increasing interest rates, volatile commodity prices and an increased likelihood of a recession in 2023

- A continuing tight labour market for key skillsets with some softening due to employee reductions within the technology industry and changing perspectives on the return to office

- New pay v. performance disclosure and clawback rules issued by the SEC in the US

- Ongoing debate on the merits of environmental, social and governance (ESG) priorities within incentive plans

- Little change in perspectives on executive compensation by investors and their advisors (e.g., ISS and Glass Lewis)

Our top five predictions for 2023 include:

Projection #1 – ESG shifting to sustainable value creation

For ESG, 2022 has been a year of ups and downs. We continue to expect a focus on ESG that will evolve from consideration of numerous – and somewhat unrelated and/or irrelevant – measures to the key issues that have a material impact on sustainable value creation. This means companies will continue to move toward better defined and articulated alignment between stakeholder and shareholder value. That is, the focus on “value” will overcome a focus on “values.”

When we refer to sustainable value, we mean value creation that can be maintained over the long-term, which includes the minimization of systemic risks. Increasingly, company values are based on intangible assets (such as brand and reputation) and systemic risks include the lack of progress on the ESG issues that are important to stakeholders, including customers, employees, and shareholders. It is not just about looking at ESG as the right thing to do, but something that is critical to sustainable value.

In our just-released report, 2023 Global Trends in Stakeholder Incentives: The Staying Power of ESG, Southlea, working with the Global Governance and Executive Compensation Group (GECN), documents a now three-year worldwide trend for the largest corporations to incorporate ESG/stakeholder metrics into executive compensation. In this report, we predict:

- Greater focus on climate and diversity measures in incentive plans

- Increasing adoption of ESG measures within long-term incentive plans (up to 28% prevalence on a global basis and only 11% in Canada)

- ESG in compensation will be increasingly quantified with discrete measures, weightings, and goals

In this report, we also articulate the critical role that HR Committees will need to play in the stakeholder incentive journey, i.e., determining whether to adopt stakeholder incentives, and if so, which measures to select, how best to incorporate such measures into the plans, and how to establish goals and verify results.

Projection #2 – Incentives under pressure

Early in 2023, HR Committees will face some difficult decisions with respect to determining incentive awards for 2022 performance and finalizing performance targets for 2023.

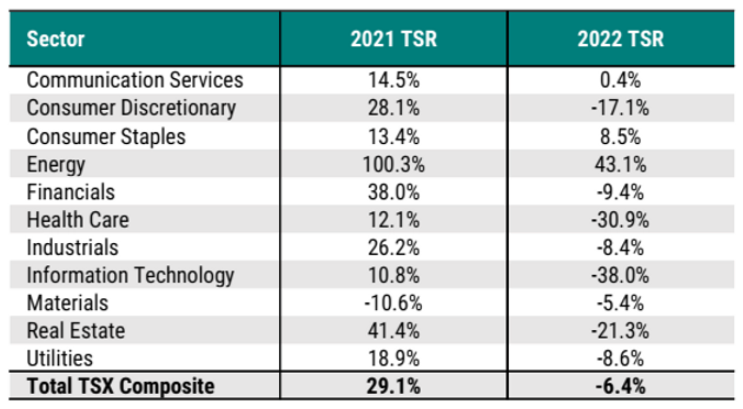

As we look back at 2022, Committees may need to reconcile a disconnect between market, financial and operating performance outcomes. TSR for the TSX Composite was down 6% for 2022 (after a 29% increase in 2021) with significant differences by sector, as outlined in Table 1 below. 2022 earnings were tracking higher, likely supporting above-target incentive awards; however, there might be questions to the degree that external factors (such as higher pricing due to inflation) impacted performance.

Table 1: 2021 and 2022 Total Shareholder Return

Committee deliberations will need to take the perspective of all stakeholders – including shareholders, employees, suppliers, customers – with clear rationale supporting the decisions made, including whether to adjust calculated outcomes and why. Developing a set of principles to guide the application of discretion can be a useful tool to support consistent decision making on a long-term basis.

For 2023, the softening market and degree of uncertainty may make it more difficult to set performance targets with confidence. There will also be greater scrutiny of these targets, particularly if they are lower than 2022 actuals. Committees will need to take a broader perspective beyond the annual budget to calibrate the performance targets and the range around target including:

- Alignment with investor expectations and guidance

- Historical performance on an absolute basis and relative to peers

Broader performance ranges may also be considered, given the degree of uncertainty and potential variability in performance outcomes. Finally, the specific performance measures may need to be adjusted to reflect 2023 priorities such as cost reductions, cash flow and financing.

Projection #3 – Greater focus on the long-term

There are several drivers that are leading to discussions on how to create real, long-term alignment between executives and stakeholders through compensation, including:

- The evolution of ESG and sustainability has extremely long-term objectives that may not be easily captured within the current incentive framework of one- and three-year performance periods

- The move away from stock options with time horizons of up to 10 years has resulted in a shortening of long-term incentive horizons from greater than three years to less than three years, raising questions on whether three years is truly “long-term”

- Challenges in developing effective three-year performance awards given market volatility, uncertainty, and change. Marc Hodak from our GECN partner, Farient Advisors, reconsiders the continuing use of performance share units (PSUs) in this recent article given challenges in picking metrics and calibrating performance targets over the long-term

- Lack of “real” share ownership, given many share ownership guidelines include unvested, notional equity – in some cases, performance equity that may or may not vest – in addition to real shares (refer to our February 2022 article for more details) and actual shareholdings may not include a meaningful number of real shares

To address these challenges, new constructs may be required, including:

- Time-vested shares with a vesting period greater than three years and potentially with a portion of vested after-tax gains held until retirement

- Longer-vesting shares tied to absolute TSR expectations (i.e., cross between a stock option and a PSU) that can be calibrated relative to an enduring performance standard v. annual budget

- Real common shares with long-term hold restrictions that would be taxed at grant (with a discounted fair value to reflect the restrictions) to attract preferential tax treatment (e.g., capital gains and dividends) and to demonstrate real share ownership

- Share ownership guidelines based on real share ownership and aligned with value received through long-term incentives (e.g., 50% of all after-tax gains) rather than specific ownership levels expressed as a multiple of salary

Projection #4 – Time to update clawback policies

As summarized in our November article, the US SEC adopted final rules requiring the clawback of erroneously awarded compensation as required under the Dodd-Frank Act which will apply to all listed companies, including Foreign Private Issuers (FPIs) in Canada. Compliant policies to be adopted by the end of 2023. Committees will need to:

- Modify the existing clawback policy, or adopt a new policy, for compliance with the new rules if you are an FPI. If not, consider whether to align on a voluntary basis

- Review which parts of the current incentive compensation arrangements would be subject to the rules and consider how a potential clawback could be determined

- Determine whether to “go beyond” the rules to address other triggers that are increasingly being considered (e.g., misconduct) or to capture other incentive compensation beyond those tied to financial reporting measures (e.g., stock options)

We anticipate that Committees may use this review process as an opportunity to revisit and refresh other governance policies and compensation decision processes that have been tested over the past few years.

Projection #5 – Holistic view of the employee experience

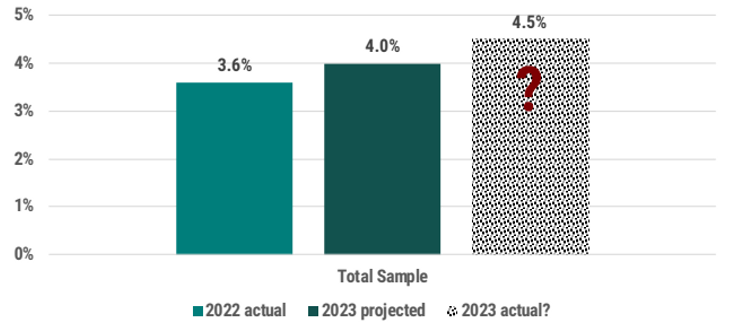

According to Southlea’s latest Compensation Planning Survey, 2023 salary budgets are expected to be higher than 2022 (refer to Figure 1 based on all salaried employees). In our experience, projections tend to underestimate actuals in a up-cycle, but are we in an up-cycle?

Figure 1: 2022 v. 2023 Salary Budget Increase Projections

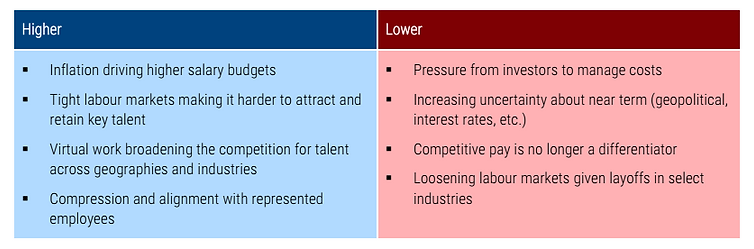

This is a complex year for determining salary increases due to several conflicting trends as outlined in Table 2.

Table 2: Factors Impacting 2023 Salary Increases

Given these challenges and the potential shift away from competitive pay as a differentiator, companies are increasingly focusing on the employee experience, which goes beyond total rewards and traditional HR programs. New differentiators include a dynamic culture and inclusive environment, effective managers and thoughtful performance management systems, efficient operations and decision-making processes, modern facilities (particularly if there is a strict return to office policy), and up to date technology. This will require HR to play a greater role in coordinating the organization to offer a comprehensive employee experience strategy.

The HR Committee plays a key role in overseeing the employee experience within the organization including:

- Asking the right questions about the employee experience strategy. How does it align with the purpose and broader business strategy? Is there consistent messaging across all employer branding? How will progress be tracked and how will “success” be measured?

- Regularly reviewing data through summary dashboards of key indicators that identify progress towards the strategy, and addressing “red flags”

- Ensuring the compensation programs align with the broader employee experience and the underlying culture, behaviours and values needed to create meaningful change

About This Author

Ryan Resch, Senior Partner

Ryan is a founder and Senior Partner of Southlea, a GECN Group company. He has over 20 years of experience consulting complex organizations across North America on executive and broad-based compensation including related governance considerations. He is often the named executive compensation consultant representing either the human resources committee and/or management. Prior to forming Southlea, he worked in Willis Towers Watson’s Toronto and Vancouver offices leading many of the practice’s large client relationships.

He leverages this expertise to bring stakeholders together and drive meaningful change aligned with key business and talent priorities. He is known for providing fresh and innovative thinking with his most recent research focused on connecting environmental, social and governance (ESG) with people and pay programs.