On March 7, 2023, the Legislative Assembly of British Columbia introduced new pay transparency legislation (Bill 13 – 2023: Pay Transparency Act, or “the Act”) to help address the gender pay gap present in the Province of British Columbia. The Act is designed to strengthen equity within the workplace by identifying unfair pay differences among groups of employees. In this article, we summarize the contents of the Act and what it means for employers in B.C., as well as what you should consider in order to comply with the new legislation.

REQUIREMENT FOR EMPLOYERS

The Act specifies the following:

Recruitment

Employers are required to:

- Publish expected salary / wage or range on all publicly advertised job postings

- Refrain from asking for a job candidate’s pay history, either in-person, or through an agent (unless the candidate’s pay history is publicly available)

As of March 2023, the Act does not require disclosure beyond base salary (e.g., incentives, pension, benefits, other perquisites).

Workforce Management

Employers are prohibited from disciplining an employee in any way, for:

- Inquiring about their pay, or the organization’s pay transparency report (content and format to be advised in updates to the Act)

- Sharing or discussing compensation with other employees or candidates

- Asking the employer to comply with the Act, or filing a non-compliance complaint

Pay Transparency Reporting

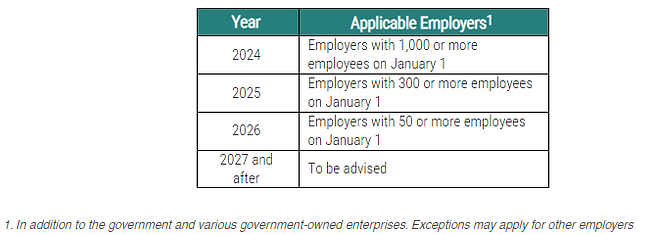

Employers are required to publish pay transparency reports by November 1 of each year, based on a graduated schedule:

The prescribed contents and format of the pay transparency reports are yet to be determined, and subject to the government’s consultation with the Indigenous peoples. Upon completion of the pay transparency report, employers must make the report accessible to all employees on the company’s website, or in a public area at the workplace (if the website option is not feasible). The pay transparency report must remain available until a new report is published.

OUR CONSIDERATIONS

The introduction of pay transparency requirements brings in new dynamics between employers and employees. Since the employees can both access pay information from public job postings, and discuss compensation with others without fear of punitive actions, it will be increasingly challenging for employers to institute or maintain pay practices that can be perceived as “unfair”.

To prepare, employers can consider the following steps:

Have a clearly defined compensation philosophy

A compensation philosophy helps align elements of compensation with business and talent strategy, setting the overall direction for how employees are paid and rewarded for their work. Guiding principles for pay decisions will be even more important in the context of pay transparency.

An example of compensation philosophy should address the following: talent market identification, target market positioning (for various levels of performance), mix of pay, flexibility, and other total rewards programs relevant to the overall employee value proposition.

Adopt a robust job architecture framework

A well-designed job architecture framework, including a job evaluation plan, provides a system for assessing the relative value of jobs to an organization, allowing for comparisons between jobs that may be very different in purpose, responsibilities, or contributions. A framework ensures fairness and consistency, the lack of which are often a source of inequity in the workplace.

In addition to pay transparency, a job architecture framework can support management in a wide range of organization-wide initiatives, including pay & benefits, talent management, succession planning, organizational design & strategy, etc. It can also help employees understand their own career paths at the organization.

Prepare compensation administration guidelines

Administration guidelines offer a framework for managing pay, guided by compensation philosophy, ensuring organization-wide strategy and philosophy are translated into individual pay decisions in a fair and consistent way, and creating a system of accountability for pay decisions.

Administration guidelines should define how a role / individual can move through the designated compensation structure considering factors such as experience, performance, evolving responsibilities, costs of living, as well as the timing and governance process.

Maintain market competitiveness

Since salary information on job postings is publicly available, employers will need to make sure that pay ranges are both internally equitable and market competitive. Outdated compensation structures will put the organization at a disadvantage in talent attraction and retention, and lead to challenges in managing current employees.

Balance disclosure and expectation setting

Salary disclosure and pay discussions create new interactions among the employer, employees, and the organization’s competitors for talent. Some employers may contemplate wider salary ranges to protect their pay information from competitors, however, doing so also necessitates the management of employee expectations, as questions on how to move up in the range will certainly arise. On the other hand, narrower ranges will help with workforce management, but risk competitors gaining insights on the organization’s pay practices. Employers will need to weigh the pros and cons from both sides and carefully assess the desired position on this continuum.

Pro-active data collection for reporting

Although the details of pay transparency reporting are yet to be announced, the reporting will likely be based on demographic data (e.g., gender, race, citizenship, age, Indigenous status, disability status, etc.). Information such as the National Occupation Classification codes can be helpful in supporting pay equity or pay transparency initiatives. Establishing the appropriate processes will help improve the efficiency in developing pay transparency reports.

It is important to note that demographic data can only be collected on the basis of voluntary disclosure, and must be handled according to privacy policies and procedures. Employers should ensure there is sufficient trust between the employees and the employer, so that these sensitive data are kept safe.

Conduct a fair pay risk assessment

Addressing pay inequity in the workplace is not a short-term process, employers should start by understanding potential areas of exposure, as well as strategies for mitigation before the Act becomes effective. This can include an overall review of the unadjusted pay ratio (average pay to females v. males) to understand the overall “headline” ratio but recognizing that this ratio is impacted by differences in employee representation at different levels in the organization v. differences in pay. Adjustments can then be made to account for roles, location, performance and other factors that drive differences in pay to determine if legitimate pay gaps exist on an adjusted basis. Different analyses can help to flag potential risks on a proactive basis including “heat maps” by employee level and function, comparisons of actual pay across demographics and more complicated regression formulae.

Train managers on compensation discussions

People managers will need to be better prepared to communicate pay decisions to employees and defend these decisions. Where feasible, an internal communications “playbook” with frequently asked questions can support the managers in having these difficult conversations. Here are some sample questions to consider:

- How is my salary determined?

- What is a salary range?

- Why am I paid lower than the others?

Lastly, employees’ questions may evolve as new and different job postings are published over time, underscoring the need for a systematic framework to compensation administration & communication, in favour of an ad hoc approach.

While there has been a lot of discussions and debate on the effectiveness of pay transparency legislation, B.C.’s Pay Transparency Act signifies an important step towards greater transparency at the workplace to help reduce inequity in the workplace. We will continue to monitor any information released regarding the Act and provide any updates as soon as it becomes available.

About This Author

Ryan Resch, Senior Partner

Ryan is a founder and Senior Partner of Southlea, a GECN Group company. He has over 20 years of experience consulting complex organizations across North America on executive and broad-based compensation including related governance considerations. He is often the named executive compensation consultant representing either the human resources committee and/or management. Prior to forming Southlea, he worked in Willis Towers Watson’s Toronto and Vancouver offices leading many of the practice’s large client relationships.

He leverages this expertise to bring stakeholders together and drive meaningful change aligned with key business and talent priorities. He is known for providing fresh and innovative thinking with his most recent research focused on connecting environmental, social and governance (ESG) with people and pay programs.