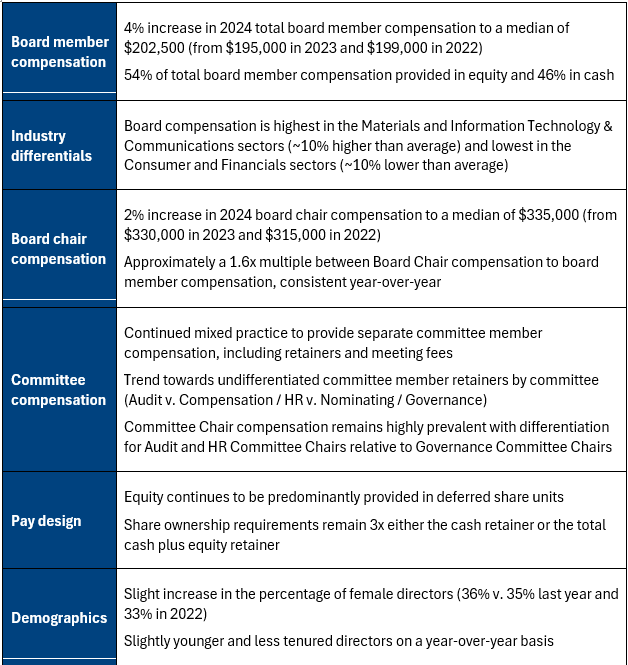

Executive Summary

Introduction

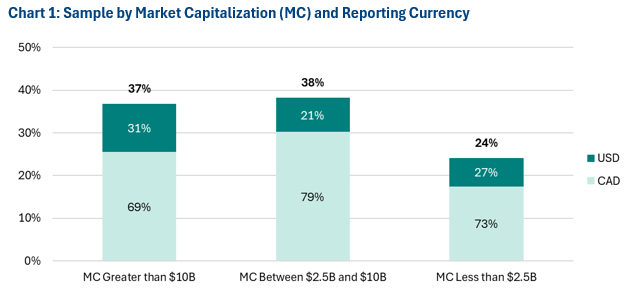

Southlea’s latest research report summarizes year-over-year director compensation trends among the companies within the S&P/TSX Composite Index. Data reflect 212 companies that disclosed compensation for their board of directors and have been summarized by company size in terms of market capitalization (MC), with a fairly well distributed group of companies in each size category. The companies in the sample largely report in Canadian dollars, though the use of USD increases among the largest companies, which tend to be more global. The data were collected by ESGAUGE, a data analytics firm.

Methodology

Data in this report reflect compensation disclosed in 2023, 2024, and 2025 proxy circulars representing 2022, 2023, and 2024 compensation levels, respectively. Total compensation is estimated based on a standard number of meetings and committee memberships (eight board meetings, two committee memberships and four committee meetings per committee) to provide an apples-to-apples comparison for similar workloads. All data are in the currency reported by each company and are summarized at par (e.g., $1CAD = $1USD). For comparison purposes, we have also provided data for the S&P 500 in USD. New for this year, we have provided data for TSX Composite companies with market cap greater than $10B for a size-adjusted comparison to the S&P 500 (median market cap of $30B CAD vs. $38B USD, respectively). Each element is independently arrayed and cannot be added to form the total.

Board Member Compensation

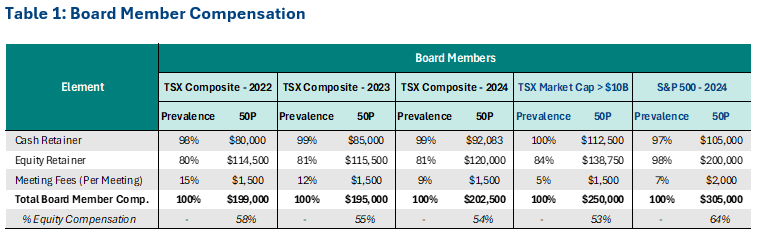

Total board member compensation for the TSX Composite rose slightly at the 50th percentile (median, or 50P) from $195,000 to $202,500 between 2023 and 2024; following a slight decrease between 2022 ($199,000) and 2023. The relative weight on compensation delivered in cash v. equity remained consistent at 54% weight on equity (cash includes the cash retainer and meeting fees where applicable).

In 2024, total board member compensation for the S&P 500 was $305,000 USD, 50% percent higher than the TSX Composite. Though this indicates that the U.S. pay premium is narrowing slightly (60% in 2023), the ability for Canadian companies to attract and retain North American / Global talent remains a hot topic. Refer to Southlea’s article: Tacking Currency Challenges in Canadian Executive Compensation for a framework to consider the inclusion of U.S.-based peers in compensation peer groups and use of converted or nominal / par dollars to review and denominate pay.

Versus the TSX Composite >$10B cut, representing a similarly sized sample, total board member compensation for the S&P 500 is 22% higher (excluding the impact of currency).

We note that the difference in the U.S. v. Canada is less for cash compensation with significantly higher equity retainers driving the overall total board member compensation difference.

Companies continue to move away from providing board meeting fees with 9% of companies (v. 12% last year and 15% the year before) continuing this practice, reflecting a persistent trend towards an “all-in” retainer structure.

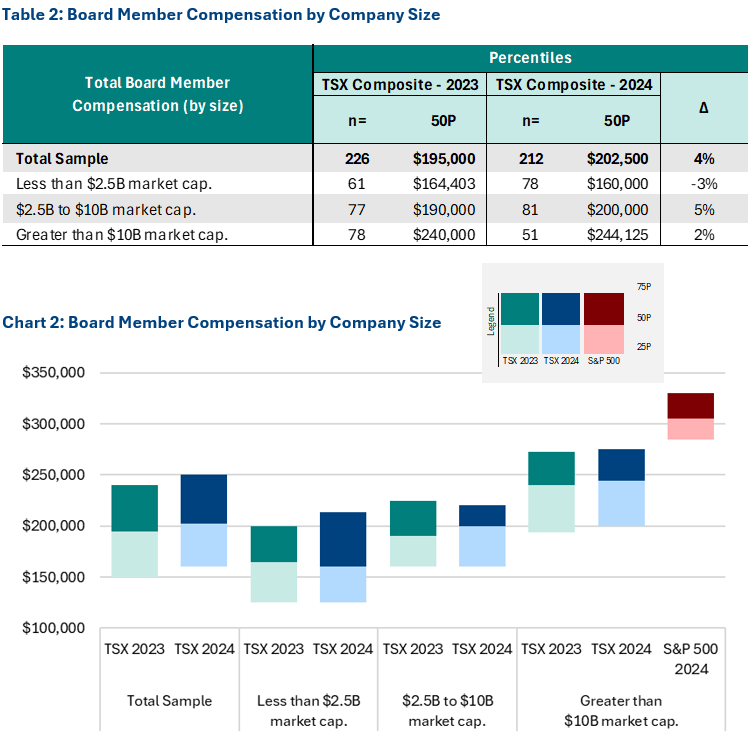

Board Member Compensation by Company Size

We observe a clear relationship between company size (in terms of market capitalization) and total board member compensation. Slightly lower to slightly higher pay levels are consistent across the sample with an approximate -3% decrease to 5% increase year-over-year depending on the size of company. The range of compensation among companies of a similar size represents the diversity of practices depending on the organization’s scope, industry, and relative complexity.

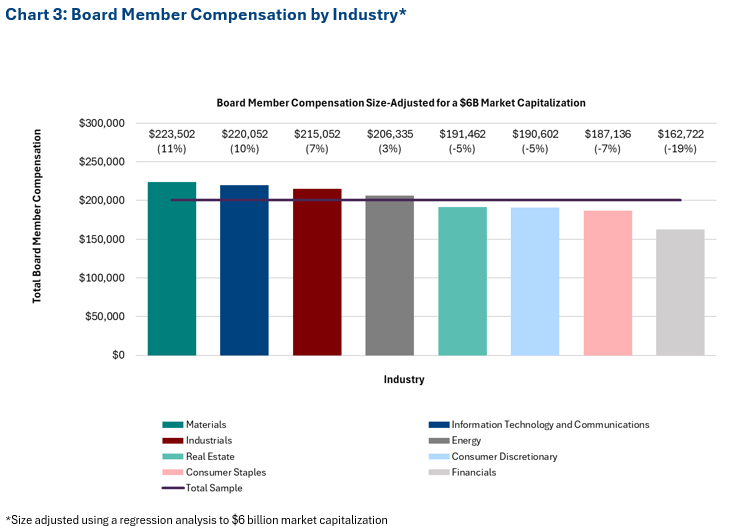

Board Member Compensation by Industry

Board member compensation is highest in the Materials and Information Technology & Communications sectors and lowest in the Consumer and Financials sectors. We note that this summary has been normalized to reflect a company with a market capitalization of $6 billion to provide a clearer perspective of the industry impact on compensation. These industry differences may reflect the different talent markets required for each industry, e.g., some industries may have a broader global talent market, or require unique skills / experience, which puts upward pressure on compensation.

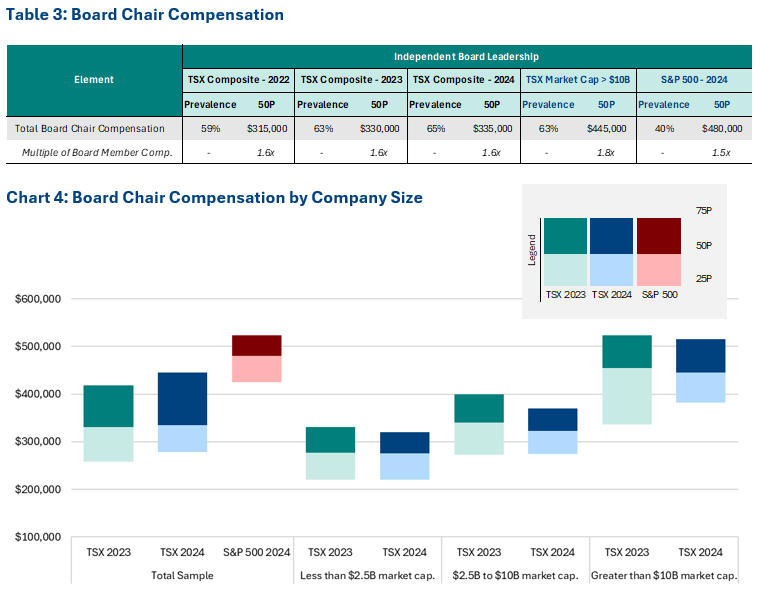

Board Chair Compensation

Of the 65% of TSX Composite companies with a non-executive Board Chair, total Board Chair compensation at the 50th percentile increased from $330,000 to $335,000, representing a 2% increase. When expressed as a multiple of board member compensation, Board Chairs receive 1.6x board member compensation at the 50th percentile, consistent with the past two years. Independent Board Chair compensation among TSX Composite companies with >$10B MC is significantly higher at $445,000, with greater differentiation v. typical Board members (1.8x).

In the U.S., approximately 40% of the S&P 500 have a non-executive Board Chair, reflecting the increased prevalence of a combined Board Chair and CEO. Non-executive Board Chair compensation is higher than in Canada at $480,000 and represents a lower multiple to board member compensation (1.5x) as found in the similarly-sized Canadian sample (1.8x).

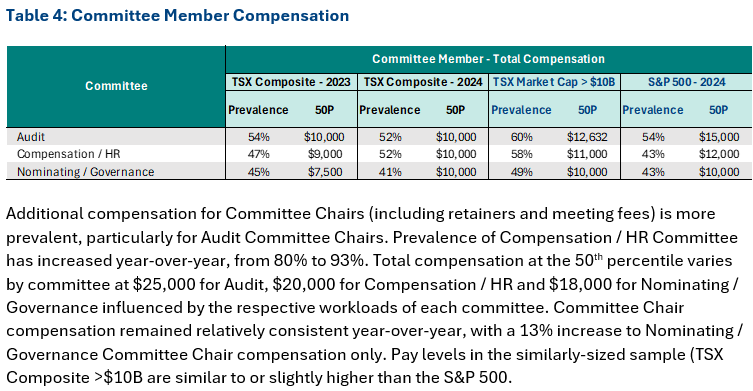

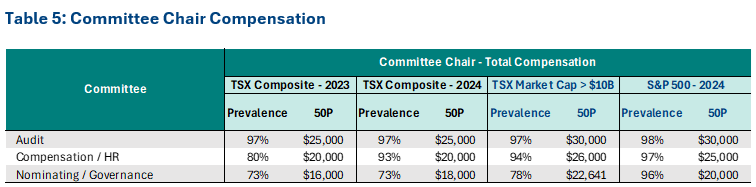

Committee Compensation

There is mixed usage of additional compensation (retainers and/or meeting fees) for committee member participation. Total committee member compensation at the 50th percentile is $10,000 for all of the Audit, Compensation / HR, and Nominating / Governance committees, indicating a trend towards undifferentiated committee compensation (2023 values of $10,000, $9,000, and $7,500, respectively). Committee member compensation in Canada remains lower than the S&P 500.

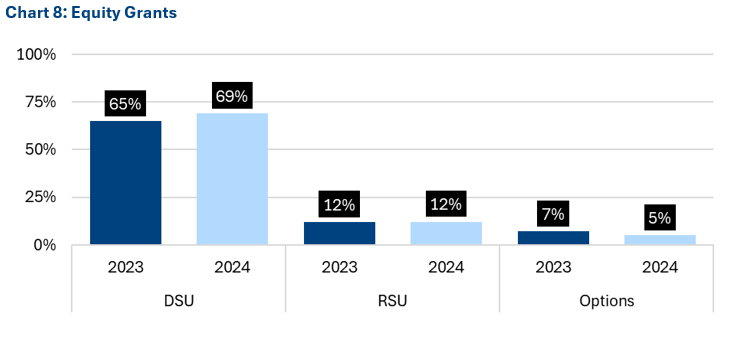

Board Equity Grants

The majority of TSX Composite companies continue to grant deferred share units (DSUs) with approximately 12% granting restricted share units (RSUs) and 5% granting stock options, with little change on a year-over-year basis. The use of stock options is typically in resource-based and/or recently public companies. In the U.S., S&P 500 companies grant equity primarily in RSUs.

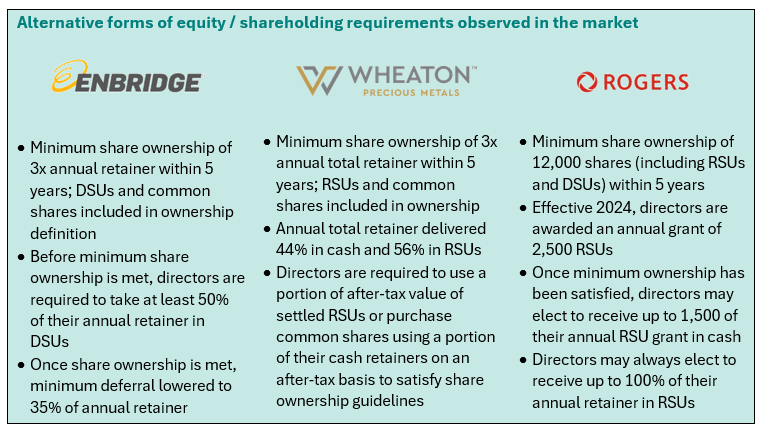

Given that DSUs are relatively illiquid and can only be redeemed when a board member leaves the board, some Canadian companies are exploring other ways to deliver equity compensation with more flexibility, particularly the use of RSUs (refer to the examples below).

Share Ownership Requirements

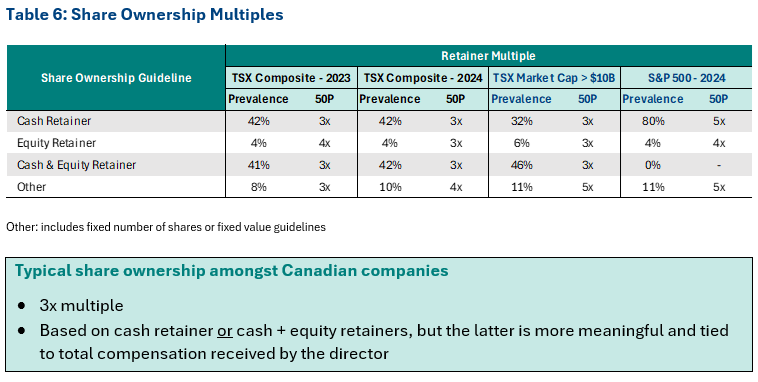

Share ownership requirements are similar year-over-year. Almost all TSX Composite companies articulate share ownership requirements for board members as either a multiple of the cash retainer or cash + equity retainers. Despite the significantly different total dollar amounts resulting from the differing ownership definitions, the median multiples of both cash and cash + equity retainers are 3.0x.

Governance influencers, including the Canadian Coalition for Good Governance in 2022 and the Globe & Mail Board Games in 2024, have expressed preferences to define executive share ownership as a multiple of total direct compensation instead of salary (analogous to total retainer instead of cash retainer for directors).

Though adoption of compliant policies has been limited, organizations can consider re-evaluating their executive and Board member share ownership guidelines to align with governance best practices.

In the U.S., most S&P 500 companies express the requirement as a multiple of the cash retainer. They also have a higher requirement at 5x the retainer (v. 3x in Canada) but that is on a relatively lower cash portion of the retainer whereas close to 40% of Canadian companies apply their requirement to the total of the cash + equity retainers.

Board Demographics

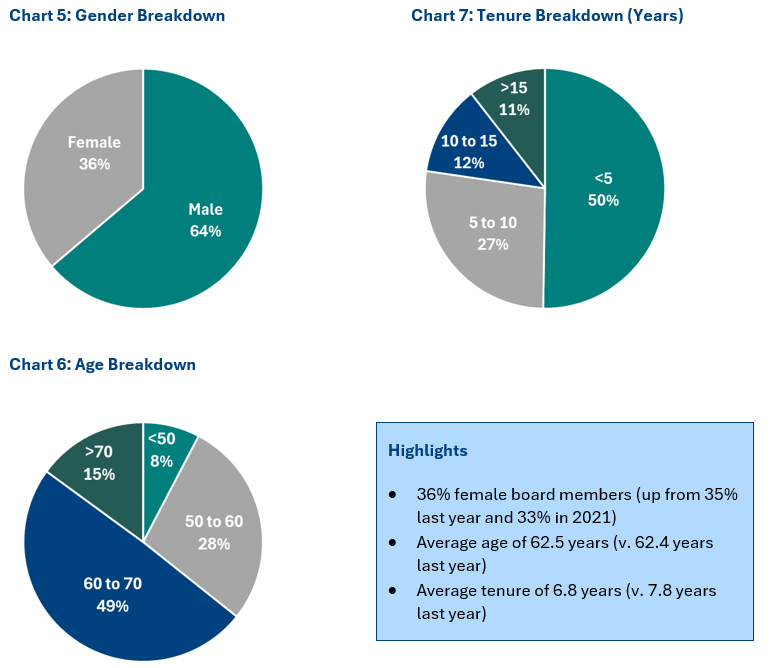

TSX Composite companies tend to have between 7 to 13 board members with an average of 36% female board members (up from 35% last year and 33% in 2022). In terms of age, 36% of board members are less than 60 (up from 35% last year) with about one-half between age 60 and 70.

Board member tenure has decreased year-over-year, with a higher proportion with less than a five-years tenure (50% this year v. 43% last year and 56% in 2022) and fewer board members serving on the board for greater than 10 years (23% this year v. 27% last year and 21% in 2022).

About The Author

Caroline Marshall, Consultant

Caroline is a Consultant at Southlea Group with four years of experience.

Prior to joining Southlea Group, she worked as an Associate at a large, global multi-service consulting firm, providing analytical support on executive and broad-based compensation projects.

She has experience supporting companies with a variety of compensation-related initiatives, including total rewards philosophy and peer group development, competitive benchmarking of board, executive, and broad-based pay, short- and long-term incentive plan design, and governance of compensation programs.

Caroline has experience working across many sectors, including financial services and Canadian pension plans.

Caroline has an Honours Business Administration degree from Wilfrid Laurier University and an Honours Mathematics degree from the University of Waterloo.