The latest iteration of the Southlea Asset Management Compensation Survey (effective April 1, 2023) was just released and covers target, actual, and theoretical maximum compensation data for over 11,000 incumbents and 500 unique roles within 29 leading Canadian pension funds, captive asset managers, and independent alternative investment firms.

Overall, in comparing data to the initial run, effective July 1, 2022, we observed relatively modest increases in target total direct compensation (TTDC) (around 3% at median for the same participants year over year), with relatively little consistent differentiation based on employee level or function. Median salaries increased ~4% over the same period.

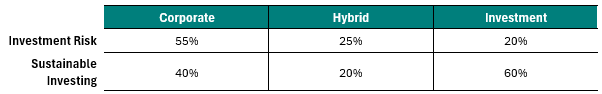

For some benchmark roles, such an investment risk and sustainable investing, we noticed significant differentiation in the range and structure of pay by organization. In these instances, aggregate statistics won’t tell the whole story, so we dug deeper into the data to glean specific insight into pay for these rapidly evolving roles.

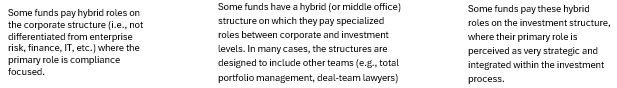

Spectrum of Pay for Hybrid Roles

Canadian asset managers are some of the most complex in the world, and investment strategies have evolved over time to include a greater focus on alternative investments and a comprehensive understanding of portfolios through an environmental, social and governance (ESG) lens. Considering this evolution, some roles supporting the investment decision-making process, such as investment risk and sustainable / responsible investment, have increased in complexity and strategic importance.

Hybrid roles also don’t often fit neatly into traditional “corporate” or “investment” categorizations (and pay practices) and the competition for talent is fierce, prompting organizations to search for detailed and specific market data and insights. Pay programs for hybrid roles can vary widely across organizations depending on their alignment with and importance to the investment strategy.

Compensation Structures

Among large (>$50B in AUM) participants surveyed, roles are organized as follows across compensation structures:

Among those with a hybrid structure, there are a few different approaches, including:

- Salary and target annual bonus opportunities aligned with investors, with lower LTIP allocations.

- Target incentive opportunities aligned with corporate employees, with a higher salary range than other corporate employees.

- Differentiated salary range and target incentive opportunities (between investment and corporate)

The alignment of these roles largely depends on the strategy of the organization and the degree to which the integrated risk or sustainable investing teams are aligned with the investment team.

Pay Differentials

Investment risk employees tend to receive around 85% of the salary paid to investors, at median; however, there are significant differences in the incentive opportunity, resulting in total compensation for investment risk employees of about 60% of the typical investor (ranging from ~35% to 75%, depending on each organization’s philosophy). This gap is more pronounced at the senior levels and decreases (i.e., to around ~85% of the average investor) at the two most junior professional levels. From a pay mix perspective, we tend to see more weight on salary and lower incentives as compared to investors.

Sustainable investment professionals fare slightly better from a pay perspective, receiving approximately 95% of the salary an average investor earns, and total compensation around 80% (ranging from ~65% to 100%). For these roles, the pay differential tends to be generally consistent across levels, at median.

Pay for these roles tends to stem from the talent pool from which candidates are most often sourced. For example, sustainable investing is a relatively new area of focus and many of these roles are filled by former active investors. While candidates may be willing to take a slight discount to active investor pay levels to do this important and impactful job, there is likely a limit on that discount (e.g., ~20%). Conversely, investment risk skillsets are commonly found in and developed from risk oversight and compliance roles (paid as a corporate role), then tailored to be more strategic and investment-aligned with the evolution of the risk function in their organization (typically paid between traditional corporate and investor roles).

Looking Ahead

Organizations are beginning to investigate whether there are other hybrid roles that require similar differentiation (e.g., data science, deal team legal and tax advisors, total portfolio management, etc.) to ensure pay levels and mix align with market expectations for the skills and experiences required.

As the landscape continues to evolve, we will monitor and report on how compensation structures and trends for hybrid roles are enhanced to align with the changing dynamics of the industry.

About the Southlea Asset Management Compensation Survey

The Southlea Asset Management survey offers the most comprehensive and relevant Canadian asset management compensation data in the market, reporting:

- Twice per year (data effective April and October of each year)

- Salary, annual and deferred / long-term incentives, and total compensation at target (1x), most recent actual, and theoretical maximum performance levels.

- Data for 50 disciplines across corporate and investment at 10 job levels, from entry to the CEO

- Published data cuts for (1) all participants, (2) firms with more than $50B in assets under management (AUM) and (3) firms with <$50B, and the ability to obtain data for custom peer groups.

About This Author

Tara Armstrong, Partner

Tara is a founder and Partner of Southlea, a GECN Group company. Prior to founding Southlea in 2021, she worked for 11 years at a large, global multi-service consulting firm, advising boards and senior management teams on effective executive and broad-based compensation program design and governance.

She helps clients align their pay programs with the organization’s purpose, values, and business strategy, and supports the selection and testing of performance measures that drive value and sustainable success.

In her former organization, Tara was the Canadian lead of the North American Executive Compensation Transactions Team, and a member of the Due Diligence Centre of Excellence.