Over the past few years, pay in the Canadian asset management sector increased significantly, largely driven by a historic bull market and extreme competition for talent amid a more global and remote workforce. With 2023’s higher inflation and interest rates, and a push “back to the office” for many organizations, we’ve observed a slowdown in pay increases across investment and corporate roles within Canadian asset management firms, and expect similar moderation in 2024.

Leveraging pay data and insights for over 400 unique roles and over 12,000 incumbents reported in Southlea’s 2023 Asset Management Compensation Surveys (effective April 1, 2023 and October 1, 2023, respectively), this article delves into the key factors driving these changes and our predictions for the first half of 2024.

Pay Increases in Asset Management: A Slowdown Across the Board

As compared to 2021 and 2022, where we observed monumental increases in salary and target compensation across many asset managers as a result of a frenzied talent market, 2023 was a year of restraint – from both a headcount and pay perspective – among most Canadian asset managers.

Comparing data between 2022 and 2023 for the same participants in Southlea’s Asset Management Compensation Survey, we observed increases in target total direct compensation (salary + incentives) of only 3%, largely driven by regular annual salary adjustments. Slightly larger increases were observed for corporate roles (4%) as compared to investment roles (1%), likely due to the significant increases in 2021 and 2022 being directed at the investor population.

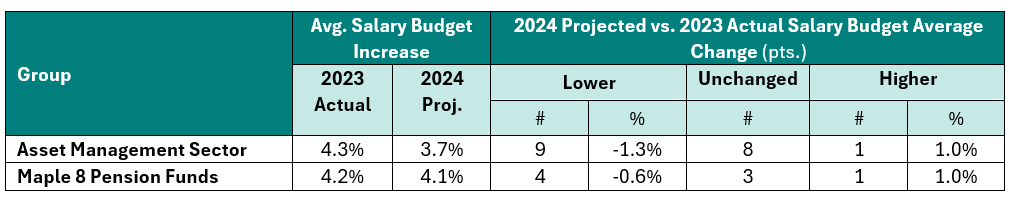

We believe this moderation will continue into 2024, with projected salary budget increase factors decreasing from 2023 actuals at many asset managers participating in Southlea’s most recent Salary Budget Planning Survey. 2024 increase projections are lower than 2023 actual budgets for half of participants (by 1.3% on average). Notably, the Maple 8 are more consistent year over year than the broader sector, with an average decrease in the budget of 0.6% among those decreasing.

This slowdown in pay increases is attributed to various factors, including:

- Increased scrutiny on investment returns net of costs (employee compensation is a significant cost for many firms);

- Higher interest rates affecting access to capital and deal flow (decreasing carry pools, fees from transactions, etc. which reduces pressure on pay across the industry); and

- Geopolitical uncertainty, high inflation, and a looming recession causing many employees to favour stability over the potential for a quick pay increase.

Asset managers are under pressure to allocate resources more efficiently, which has led to a more conservative approach to compensation than that observed in the recent past.

The “New Normal” in Junior Investor Compensation

Junior investor pay levels were the subject of the most significant increases during the 2021 / 2022 “run up”, with some organizations increasing entry-level investor pay by up to 30%. And while competition for this talent has cooled in recent months, we are not seeing a reduction in starting rates. This so-called “new normal” in compensation is partly a response to the industry’s ongoing effort to attract and retain young talent. Asset management firms recognize the need to remain competitive in a crowded job market, particularly as this “mobile” population may be lured by significant pay premiums offered by US firms, and offering competitive compensation to junior investors is one way to achieve that goal.

Lower Turnover and Time to Fill Ratios

Similar to trends in compensation, the competition for talent appears to be dampening with lower turnover figures (voluntary and involuntary), along with a reported reduction in the “time-to-fill” new / existing roles. Economic uncertainty, market volatility, and a tightening of the corporate purse strings has dissuaded many professionals from switching jobs in pursuit of higher salaries, contributing to a more stable workforce. As the frenetic competition for talent has been muted, at least for the time being, asset management firms have the opportunity to be more selective and to emphasize finding the right fit over rapid recruitment. This shift benefits both employers and employees by promoting job stability and reducing recruitment costs.

Looking Ahead

The evolving compensation trends in asset management reflect the industry’s response to changing dynamics and a more cautious approach to resource allocation. The industry’s ability to adapt will play a crucial role in its long-term success and sustainability in a dynamic financial environment.

As we continue to observe challenging market conditions through early 2024, we believe compensation will be relatively consistent to slightly down in the near-term. Even for those with incentive plans designed to withstand short-term volatilities, prolonged market pressures will have a negative impact on incentive payouts, leading to a potential decrease in pay year over year.

About the Southlea Asset Management Compensation Survey

The Southlea Asset Management survey offers the most comprehensive and relevant Canadian asset management compensation data in the market, reporting:

- Data for more than 30 leading Canadian pension funds, captive asset managers, and independent alternative investment firms

- Twice per year (data effective April and October of each year)

- Salary, annual and deferred / long-term incentives, and total compensation at target (1x), most recent actual, and theoretical maximum performance levels

- Data for over 400 jobs across 50 corporate and investment disciplines at 12 job levels, from administrative assistant to the CEO

- Published data cuts for (1) all participants, (2) firms with more than $50B in assets under management (AUM) and (3) firms with <$50B, and the ability to obtain data for custom peer groups (e.g., alternative asset managers, including carry dollars at work)

About This Author

Tara Armstrong, Partner

Tara is a founder and Partner of Southlea, a GECN Group company. Prior to founding Southlea in 2021, she worked for 11 years at a large, global multi-service consulting firm, advising boards and senior management teams on effective executive and broad-based compensation program design and governance.

She helps clients align their pay programs with the organization’s purpose, values, and business strategy, and supports the selection and testing of performance measures that drive value and sustainable success.

In her former organization, Tara was the Canadian lead of the North American Executive Compensation Transactions Team, and a member of the Due Diligence Centre of Excellence.