Short-term incentive (STI) performance objective setting is an increasingly hot topic among boards and management teams. While target pay levels have long been benchmarked versus market, new scrutiny is being directed towards the performance objectives underlying the incentive plans that drive actual pay outcomes. Selecting the right performance measures and setting targets appropriately is critical to ensuring pay for performance alignment, incentivizing behaviours in alignment with company strategy, and retaining and motivating talent.

As trusted advisors to Human Resources Committees (HRC) and management teams across Canada, we wanted to explore how large Canadian and U.S. companies (defined as the companies in the S&P/TSX 60 and S&P 500 indices) have set performance objectives and used them to decide pay outcomes. Our analysis studies STI performance and payouts over the past three years (from 2021 to 2023), leveraging market data collected by ESGAUGE.

Key Takeaways

- Average performance in STI measures has declined in Canada and the U.S. between 2021-2023, though generally performance continues to be above target.

- U.S. organizations performed below threshold or above maximum (out of range) more than Canadian ones.

- Extra-Financial / ESG metrics in Canada are most likely to perform below target, due to the prevalence of safety measures given their objectivity and punitive nature.

- The range width of objectives varies by measure type, with revenue metrics having the narrowest range and cash flow and other quantifiable financial metrics the widest.

- Average STI payouts are positively correlated with total shareholder return, indicating pay for performance alignment.

Incentive Outcomes

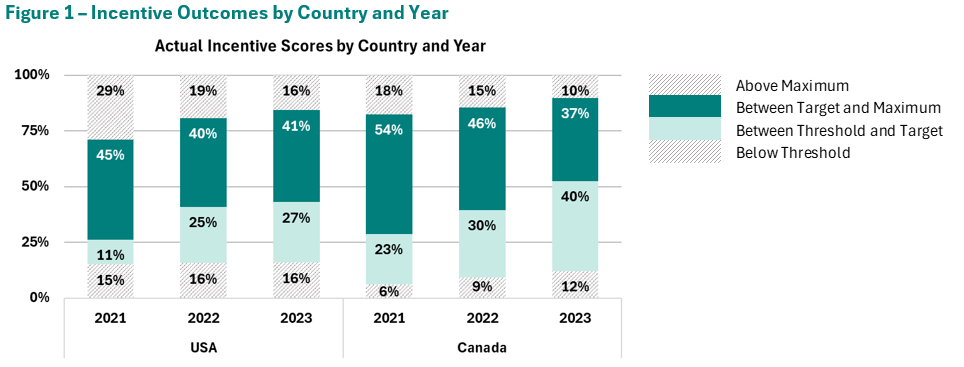

There has been a downward trend in STI performance in both the U.S. and Canada between 2021 and 2023, as shown in Figure 1 with the lower prevalence of above target versus below target outcomes. This is attributed to uncertainty and low target setting during the COVID-19 pandemic followed by a period of normalization.

U.S. companies performed below threshold and above maximum (out of range) more often than Canadian ones, which may be due to differences in governance environments and risk tolerance between the two countries.

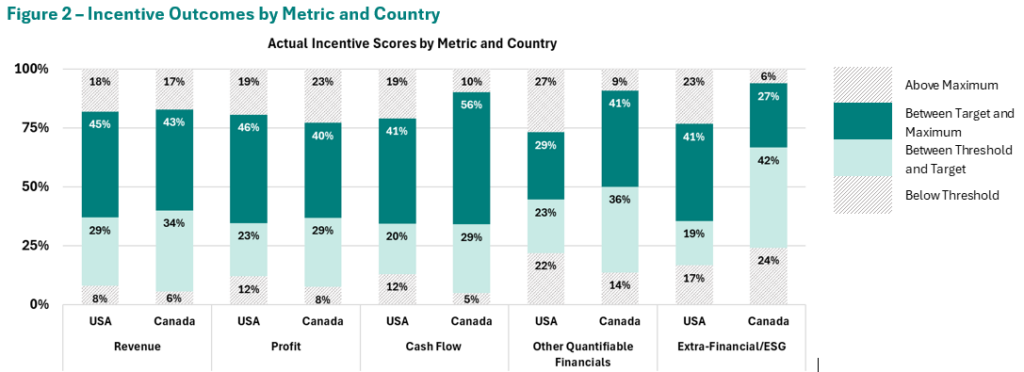

Performance outcomes versus target vary by performance metric. As shown in Figure 2, the other quantifiable financials and extra-financials / ESG metrics are associated with greater values outside of range, especially in the U.S. This indicates weaker target setting for less established metrics. In addition, most of the financial measures tend to skew above maximum v. below threshold indicating a degree of conservatism within target setting.

We note that Canadian performance in ESG metrics is much lower than in the U.S. or any other metric. This is likely due to Canada’s significant resources industry and prevalence of safety metrics, which are objective and tend to have a greater likelihood of below target outcomes.

Performance Ranges and Payouts

Performance range widths are symmetrical about target but vary by measure, as shown in Figure 3 given the potential variability in each of the measures. Of the major financial metrics, revenue metrics have the narrowest range, followed by profit, with cash flow metrics having the widest ranges. This aligns with their respective sensitivity and variability – while revenue is more stable, profit outcomes are influenced by cost management and non-operating expenses such as tax and interest. Cash flow is highly responsive to changes in operations, financing, and investing activities – performance objectives have been set accordingly.

Pay to Performance Relationship

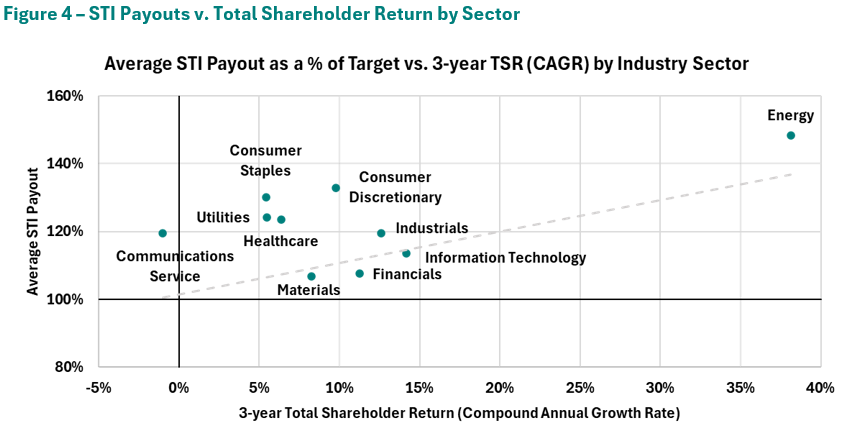

STI payouts are positively correlated with market performance, as depicted in Figure 4. The energy sector demonstrates the strongest pay for performance alignment, with the highest 3-year compound annual growth rate in total shareholder return at 38% and an average STI payout of 148% of target.

About The Authors

Caroline Marshall, Consultant

Caroline is a Consultant at Southlea Group. Prior to joining Southlea Group, she worked as an Associate at a large, global multi-service consulting firm, providing analytical support on executive and broad-based compensation projects.

She has experience supporting companies with a variety of compensation-related initiatives, including total rewards philosophy and peer group development, competitive benchmarking of board, executive, and broad-based pay, short- and long-term incentive plan design, and governance of compensation programs.

Industry Focus

Caroline has experience working across many sectors, including financial services and Canadian pension plans.

Education

Caroline has an Honours Business Administration degree from Wilfrid Laurier University and an Honours Mathematics degree from the University of Waterloo.