The following memorandum summarizes the say on pay voting results in Canada (among the TSX Composite companies) and the U.S. (among the S&P 500 companies) based on results released by end of May 2024.

Canada Results

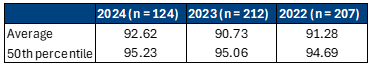

At this point in the AGM cycle, 124 Canadian companies have reported their say on pay results for 2024. We are seeing very similar overall results this year as summarized in Table 1. The average results have gone up by 2 percentage points for the overall sample indicating proactive governance practices by the companies.

Table 1 – Canada say on pay results

Notably, companies are paying increased attention to the say on pay vote, recognizing its significance in shareholder engagement and governance practices. In response to this heightened scrutiny, The Globe and Mail’s ‘Board Games’– a prominent measure of corporate governance in Canada, has adjusted its evaluation criteria. Specifically, they increased the minimum threshold to receive maximum points at 95% (from 80% in prior years). This shift underscores a fundamental change in prioritizing shareholder engagement and responsiveness. Companies are now incentivized to not only secure higher levels of support for their executive compensation plans but also to transparently communicate any adjustments made in response to shareholder feedback.

Both ISS and Glass Lewis continue to expect companies to respond to say on pay votes with less than 80% support. This response usually includes some level of shareholder engagement and appropriate changes (such as incentive plan design changes, disclosure improvements, etc.), where warranted.

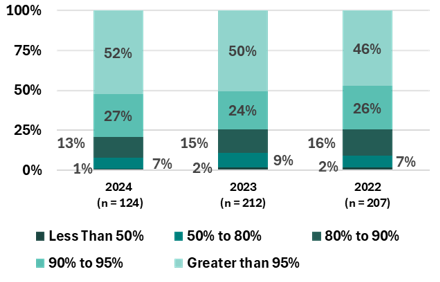

As illustrated in Chart 1, the distribution of say on pay results indicate consistent year-over-year support with 52% of companies receiving over 95% support, 27% receiving 90% to 95% support, 13% receiving 80% to 90% support and 8% receiving 50% to 80% support (or 9 companies) and 1 company failing.

Chart 1 – Distribution of Canada say on pay results

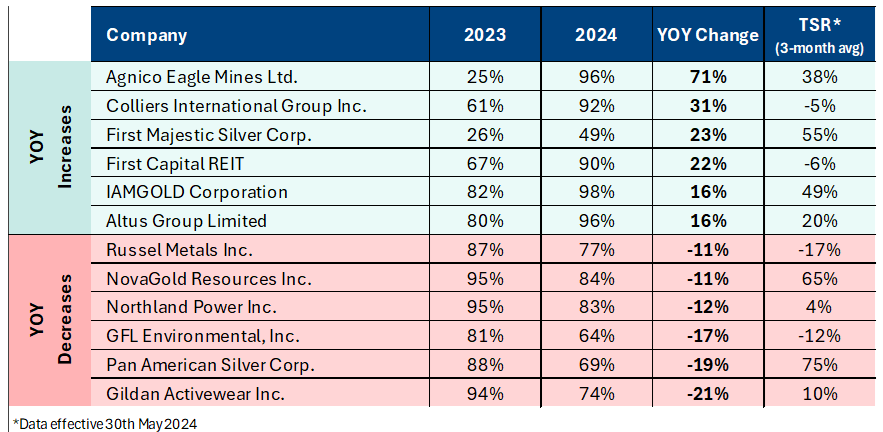

Of the 124 reporting companies, close to 85% of companies reported results that changed less than 10 percentage points on a year-over-year basis. Only 1 company (First Majestic Silver Corp.) in the TSX composite has failed so far with the minimum score being 49% (as of May 31st). Table 2 summarizes the companies with the biggest year-over-year increases and decreases in their voting levels.

Table 2 – Biggest year-over-year changes in say on pay voting results

US Results

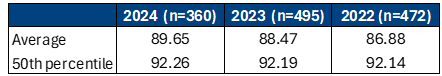

In the US, among the 360 S&P 500 companies that reported as of the end of May 2024, the average level of support has increased from 88% to 90% (refer to Table 1).

Table 1 – US say on pay results

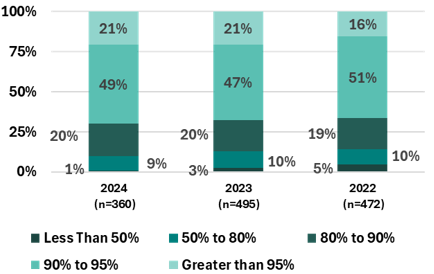

The percentage of companies receiving over 95% support remained steady at 21% (which is less than half of Canada’s support at this level). However, the proportion of companies garnering between 90% and 95% support rose to 49%. Additionally, the share of companies with less than 50% support decreased from 3% in 2023 to just 1% in 2024, as illustrated in Chart 2.

Chart 2 – Distribution of US say on pay results

Key Insights

- Shareholder expectations are rising. Where support has materially dropped year-over-year, investors are increasingly expecting companies to proactively reach out to key investors and address potential concerns in the executive compensation programs. The new minimum threshold within Board Games is putting increasing pressure on Canadian companies to maximize their say on pay scores, despite Canadian companies having stronger say on pay results than in the US

- Shareholder perspectives on executive compensation are nuanced. However, it is important to note that companies can receive a sudden withdrawal of support for many reasons, including special one-time compensation awards, underperformance and unique program designs. The ability to influence the score is also dependent on each company’s unique shareholder base and their specific voting guidelines, which can vary materially depending on their basis for good practices (e.g., European v. North American investors). Building a deep understanding of your specific investor preferences can help you evaluate program and disclosure improvements

- Continuous monitoring and improvements are key. We advocate for balance against what the proxy advisors and “common market practice” are suggesting ensuring alignment with both your business and talent strategies. This means that companies need to stay on top of the effectiveness of their programs, which includes:

- Continually monitoring the relationship between realized pay and actual absolute/relative performance,

- Adjusting programs as needed to align with your strategy and what is in the best interests of the company, and

- Ensuring that key messages are clearly articulated to shareholders, through regular disclosure and supplemental disclosure or individual meetings as needed

About The Authors

Ryan Resch, Senior Partner & Amanda Wildi, Consultant

Ryan is a founder and Senior Partner of Southlea, a GECN Group company. He has over 20 years of experience consulting complex organizations across North America on executive and broad-based compensation including related governance considerations. He is often the named executive compensation consultant representing either the human resources committee and/or management. Prior to forming Southlea, he worked in Willis Towers Watson’s Toronto and Vancouver offices leading many of the practice’s large client relationships.

He leverages this expertise to bring stakeholders together and drive meaningful change aligned with key business and talent priorities. He is known for providing fresh and innovative thinking with his most recent research focused on connecting environmental, social and governance (ESG) with people and pay programs.

Amanda is a Consultant Southlea Group. She started her career at Willis Towers Watson in their Rewards practice providing project management and analytical support to clients at both the senior management and board levels to address a variety of executive compensation, workforce compensation, and broader human resource priorities.

Amanda has worked with publicly-traded, privately-held, and subsidiary organizations across a broad range of industries including financial services, energy services & utilities, and consumer goods. Prior to joining Southlea Group, Amanda worked at ZS Associates and Forma AI. Amanda has a Bachelors of Commerce with a Specialist in Finance and Economics from the University of Toronto.