The US Securities and Exchange Commission (SEC) adopted final rules requiring the clawback of erroneously awarded compensation as required under the Dodd-Frank Act. This was long awaited as Canadian companies debated whether to align with earlier iterations of the proposed rules as they developed and/or reviewed their clawback provisions in response to investor pressures. For the most part, there are no specific clawback requirements for Canadian companies (some exceptions apply such as those complying with the U.S. Sarbanes-Oxley Act [SOX] or Office of the Superintendent of Financial Institutions [OSFI] best practices), so the clawback policies – particularly those that go beyond SOX requirements – have generally been voluntarily adopted as a good governance practice.

The new SEC rules apply to all listed companies, including Foreign Private Issuers (FPIs), which would include many Canadian companies that are dual-listed in the U.S. We note that this is different from the recently adopted pay vs. performance rules which exempted FPIs.

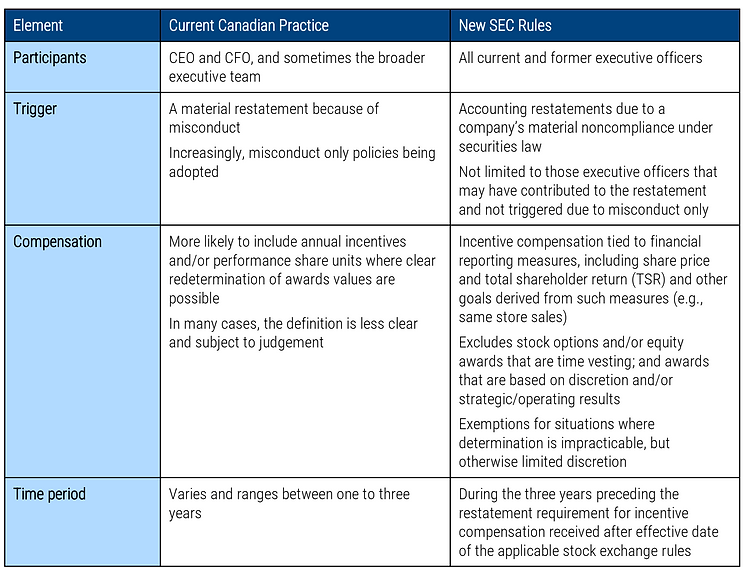

At a high level, below is a short summary of the new rules relative to “typical” Canadian practices (note: this is not to represent a legal interpretation of the rules):

Please refer our U.S. partner, Farient Advisors, for further details on the new SEC rules.

IMPLICATIONS

As Canadian companies review the implications of the new SEC rules, particularly FPIs, we suggest the following:

- Review your existing clawback policy for compliance with the new SEC rules which will likely require a compliant policy to be adopted by the end of 2023 for FPIs. For other Canadian companies, consider whether to align with the new SEC rules for consistency purposes. Identify changes and understand the implications of these changes

- Consider adoption of a clawback policy for companies that have yet to adopt a policy and/or were awaiting the release of these rules given that there might be increasing pressure to adopt a policy. It is still unclear whether the new SEC rule may impact the perspective of Canadian regulators

- Determine whether to “go beyond” the rules to address other triggers that are increasingly being considered. For example, consider whether the clawback policy should include a misconduct-only trigger that could be applied in situations where there is a material breach of a company policy that has a significant impact on the company’s performance and/or reputation

- Review which parts of the current incentive compensation arrangements would be subject to the rules (i.e., “financial reporting measures”) and consider how a potential clawback could be determined, particularly for share price/TSR measures that may not have a clear or direct connection to a restatement of financial performance

Interested in learning more about working with Southlea? Click here

Click to view our Service Offerings